Do Nonprofit Organizations Get 1099

1099-MISC only when payments are made in the course of your trade or business. If the charity does issue then it must also forward a copy of the 1099s to the IRS.

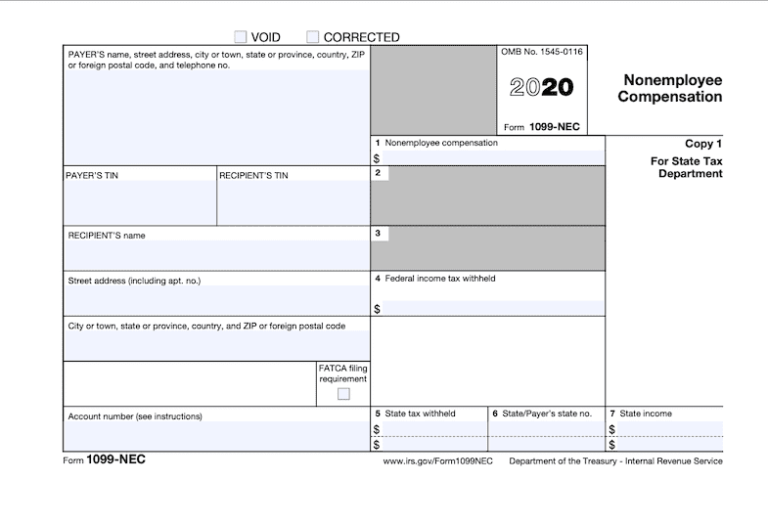

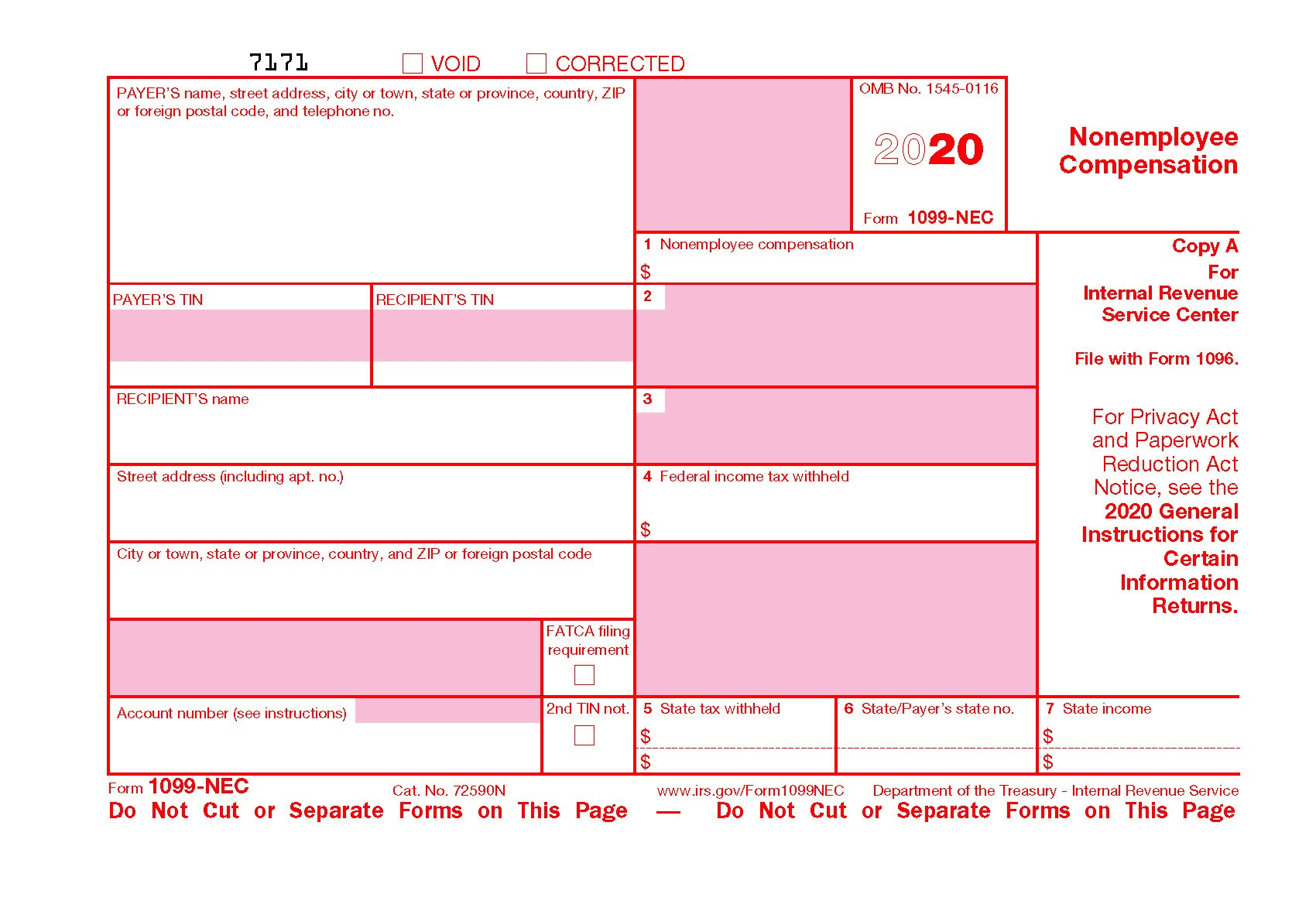

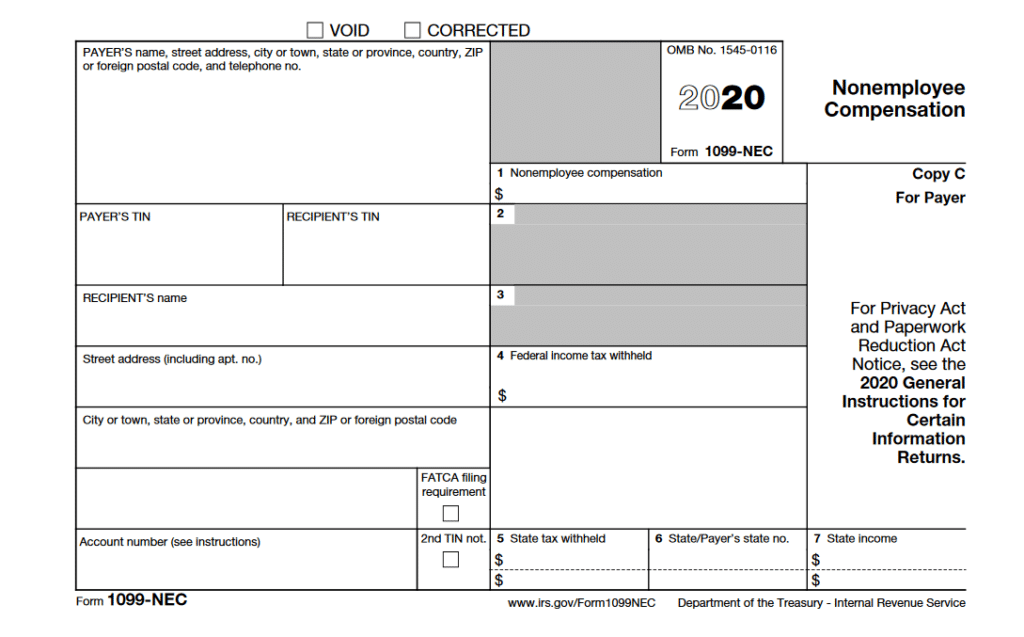

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

You are engaged in a trade or business if you operate for gain or profit.

Do nonprofit organizations get 1099. For most nonprofits the primary concern is Form 1099-MISC which is required. For 2020 reporting you must report payments to non-employees on Form 1099-NEC non-employee compensation. For most small nonprofit organizations its nonemployee compensationand the 1099-MISCform that we need to focus on.

Since nonprofit organizations are corporations a 1099-MISC will not be used. As a result business owners government agencies and nonprofits including churches have two 1099s that commonly require attention. The IRS recently concluded under Reg.

You need to issue a 1099 tax form when the following four conditions are met. There are all kinds of different income categories and different form types under the 1099 umbrella. A nonprofit organization has the same responsibility as a business when it comes to issuing 1099 information forms.

For nonprofits you must issue this form when you contract individual workers and vendors to complete work for the organization. An independent contractor is defined as a non-corporate business entity such as a sole proprietor or partnership. Generally if the organization pays at least 600 during the year to a non-employee for services including parts and materials performed in the course of the organizations business it must furnish a Form 1099-MISC Miscellaneous Income to that person by January 31 of the following year.

Dont use Form 1099-MiSC to report payments to non-employees including independent contractors. Then after several years of reporting-confusion the IRS reinstated Form 1099-NEC in 2020. This form has been redesigned for 2020 to remove the reporting of non-employee income from independent contractors for example.

Bylaws of the organization may prohibit or limit compensation for board members but bylaws may also be silent on this topic. Non profits are usually set up as corporations. However nonprofit organizations are considered to be engaged in a trade or business and are subject to these reporting requirements.

An independent contractor is defined as a non-corporate business entity such as an sole proprietor or partnership. Nonprofits must file 1099s just like any other organization. 1099s need to be mailed by January 31 so dont wait.

If so then be sure to include the 1099K contribution revenue in the totals reported on your 990N form and do not need to report it anywhere else. 16041-3 that LLCs are not corporations and should be. Corporate nonprofits operate for the public good and those that surpass the minimum annual contribution amount have strong reporting requirements.

Under current law a non-profit is required to give a Form 1099-MISC to any independent contractor who provides services and is paid 600 or greater in a calendar year ie. Form 1099-NEC and 1099-MISC What and Why. These forms are vital tax-compliance tools.

Medical or Health care payments are reportable but non-employee compensation contractor payments are not reported. Personalpayments are not reportable. This has the benefit of sidestepping the donors need to get a.

A 1099 form is used to report certain non-salary income to earners of that income and to the IRS for tax purposes. In to order to file Form 1099 online every non-profit organizations need to have book-keeping systems. 1099 Rules indicate that corporations are exempt from receiving 1099 statements EXCEPT for certain items which you must report on a 1099.

As long as the Paypal account is listed in the name of the non-profit organization my assumption is that the funds received through Paypal were charitable contributions to your non-profit organization. Do nonprofits need to do 1099s. If board members are paid more than 600 per year the nonprofit must issue them an IRS Form 1099 Msc.

Personal payments are not reportable. Under current law a business is required to give a Form 1099-MISC to any independent contractor who is paid 600 or greater in a calendar year. You are engaged in a trade or business if you operate for gain or profit.

Thats because youll need to track the payments you make to all individuals subcontractors and independent contractors from whom you buy services. For most businesses this doesnt create much of a burden. A Form 1099 is the miscellaneous income tax form used to prepare and file income information that is separate from wages salaries or tips.

Current IRS Regulations require that information returns be issued to all non-corporate businesses that provide goods or services to the Organization aggregating 600 or more during the year. Report on Form 1099-MISC only when payments are made in the course of your trade or business.

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

2021 Irs Deadlines For Nonprofits In 2021 Irs Forms Helpful Hints Irs

2021 Irs Deadlines For Nonprofits In 2021 Irs Forms Helpful Hints Irs

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Nec Tax Services Accounting Firms Accounting Services

1099 Nec Tax Services Accounting Firms Accounting Services

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Keeping Track A Checklist For Your Nonprofit S Month And Year End Checklist Accounting Nonprofit Management

Keeping Track A Checklist For Your Nonprofit S Month And Year End Checklist Accounting Nonprofit Management

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

New Irs Form 1099 Nec For Nonemployee Compensation Vero Beach Fl Accountant Kega Cpas

New Irs Form 1099 Nec For Nonemployee Compensation Vero Beach Fl Accountant Kega Cpas

Quickbooks Online Vs Xero Accounting Software Cloud Based Solutions For Nonprofit Organizations Such As Cloud Accounting Accounting Software Quickbooks Online

Quickbooks Online Vs Xero Accounting Software Cloud Based Solutions For Nonprofit Organizations Such As Cloud Accounting Accounting Software Quickbooks Online

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

W2 Vs 1099 Which Is Better For Employees 1099 Tax Form Efile Online

W2 Vs 1099 Which Is Better For Employees 1099 Tax Form Efile Online

The Difference Between Independent Contractor And Employee Infographic Employee Infographic Independent Contractor Contractors

The Difference Between Independent Contractor And Employee Infographic Employee Infographic Independent Contractor Contractors

Who Are Independent Contractors And How Can I Get 1099s For Free