How To Calculate Business Activity Statement

Calculate your total revenue. Calculate And Report GST Quarterly If the business is using Option 1 or Option 2 you can work out your GST using either the calculation sheet method or the accounts method.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg) Cash Flow From Investing Activities

Cash Flow From Investing Activities

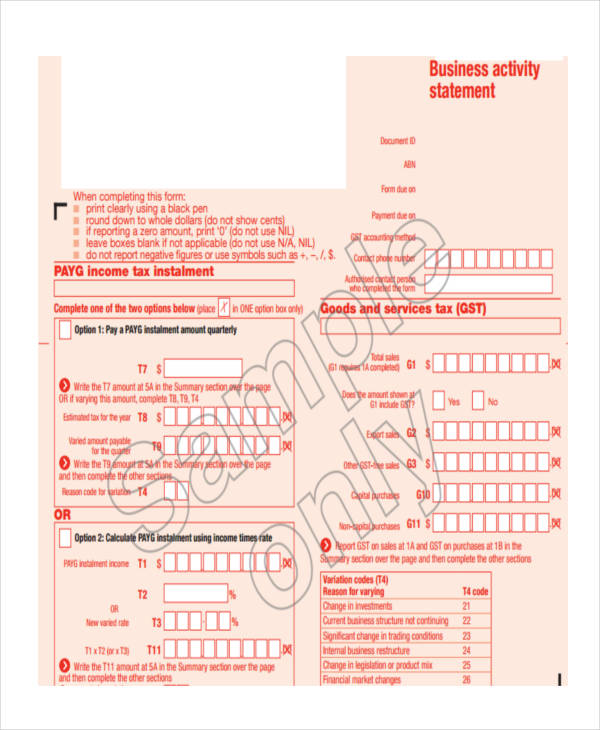

Step 1 Complete sales on the front of your activity statement 18 G1 Total sales 18.

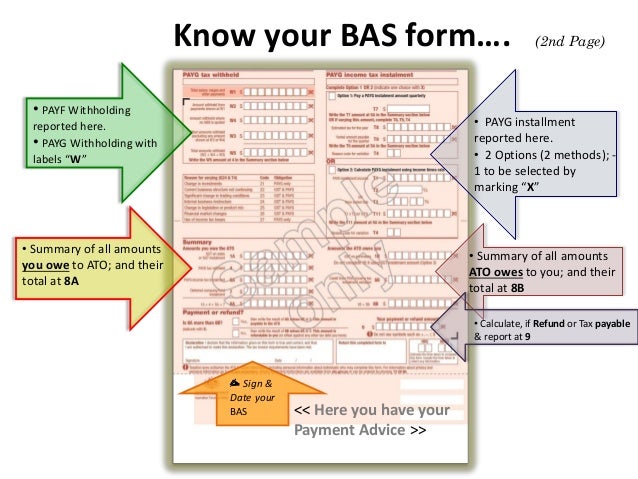

How to calculate business activity statement. Calculate PAYG instalment using income times rate Reason code for variation T4 OR New varied rate T3. Making calculations to report your amounts at 1A GST on sales and 1B GST on purchases following the instructions on the worksheet to transfer the amounts to the appropriate GST labels on your BAS. Because your BAS may also be used for other tax reasons you will probably need to provide extra information about your business its income and any employees.

Activity statements are issued by the ATO so that businesses can report and pay a number of tax liabilities on the one form at the one time. If you are new to making a Business Activity Statement then it would be a good idea to take some guidance from this template. If you are using the calculation worksheet method you need to complete all Steps 1 to 6.

Learn more on the ATO page about business activity statements. In simple terms your taxable income is the amount of money you make from your goods and services in a financial year not including GSTmore on that later minus your business expenses which we cover below. Now that your information is accurate its time to calculate your totals.

For example if you earn 100000 and have business expenses totalling 18250 your taxable income will be 81750. If the business is using the calculation sheet method use the calculation sheet to work out your GST. You can lodge your BAS.

The Australian Taxation Office ATO will send your activity statement about 2 weeks before the end of your reporting period. After registering with an ABN and for GST Uber drivers then need to lodge a business activity statement BAS on a regular basis. Ensure you select the correct financial year.

There are two types of activity statements an instalment activity statement IAS and a business activity statement BAS. In the Lodge Manually tab select the last month of your reporting period. Subtract your businesss expenses and operating costs from your total revenue.

Calculate your totals and enter figures. AcTIVITy STATemenT 07 compleTInG The GST boxeS on your aCtivity statement 18 If you are using the accounts method you only need to complete Steps 1 3 5 and 6. You can do this via a report in your accounting software or adding up all your numbers if you use a manual method see GST calculation worksheet.

The due date for your monthly business activity statement is usually on the 21st day of the following month. Your BAS will help you report and pay your. While the exact formula will be different for every company depending on the items they have on their income statement and balance sheet there is a generic cash flow from operations formula that can be used.

Through a registered tax or BAS agent. Cash Flow from Operations Net Income. It is a guide to completing your BAS providing a step-by-step instruction that aims to instruct you along with the taxpayers on how to complete the Business Activity Statement.

Online through the Business Portal or Standard Business Reporting SBR software. For example FY16 refers to the financial year ending in 2016. Completing the worksheet using information from your accounts.

If the financial year you need to prepare a BAS for is not available youll. The normal BAS statement lodgment cycle is quarterly. Once you have your totals transfer them to.

Complete and return by the due date on your BAS along with any payment due. Returns are officially required to be lodged within 28 days of the end of the quarter allowing for public. T2 Write the T7 amount at 5A in the Summary section OR if varying this amount complete T8 T9 T4 Write the T9 amount at 5A in the Summary section Write the F1 amount at 6A in the Summary section OR if varying this amount complete F2 F3 F4.

The due dates depend on whether you lodge your BAS monthly or quarterly. Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS. To start your calculation follow these steps.

Goods and services tax GST pay as you go PAYG instalments. Once you receive your business activity statement fill it out lodge it with the ATO and pay any money you owe by the due date. Put an X in the Yes box under G1 on the front of the BAS.

Your Profit Loss Statement Can Attempts To Relate The Expenses And Profit Of The Specific Time Per Profit And Loss Statement Statement Template Excel Templates

Your Profit Loss Statement Can Attempts To Relate The Expenses And Profit Of The Specific Time Per Profit And Loss Statement Statement Template Excel Templates

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg) Cash Flow Statement Analyzing Cash Flow From Investing Activities

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Free 9 Business Statement Examples Samples In Pdf Examples

Free 9 Business Statement Examples Samples In Pdf Examples

42 Profit And Loss Statement Template For Professional Business Reports Profit And Loss Statement Statement Template Cash Flow Statement

42 Profit And Loss Statement Template For Professional Business Reports Profit And Loss Statement Statement Template Cash Flow Statement

A Cash Flow Statement Template Is A Financial Document That Provides Valuable Information About A Compan Cash Flow Statement Accounting Basics Accounting Notes

A Cash Flow Statement Template Is A Financial Document That Provides Valuable Information About A Compan Cash Flow Statement Accounting Basics Accounting Notes

Sample Financial Reports Report Templates Annual For School Example Within Quarterly Re Income Statement Personal Financial Statement Profit And Loss Statement

Sample Financial Reports Report Templates Annual For School Example Within Quarterly Re Income Statement Personal Financial Statement Profit And Loss Statement

Margin Vs Markup Chart How To Calculate Margin And Markup Business Resources Accounting Business Marketing

Margin Vs Markup Chart How To Calculate Margin And Markup Business Resources Accounting Business Marketing

An Example Profit Amp Loss Statement To Help You With Your Smallbusines Ilovetobeselling Profit And Loss Statement Tax Refund Income Statement

An Example Profit Amp Loss Statement To Help You With Your Smallbusines Ilovetobeselling Profit And Loss Statement Tax Refund Income Statement

Bas Business Activity Statement Presentation

Bas Business Activity Statement Presentation

Ytd Profit And Loss Statement Template Income Statement Statement Template Personal Financial Statement

Ytd Profit And Loss Statement Template Income Statement Statement Template Personal Financial Statement

Image Result For Cash Flow Statement Template Contents Cash Flow Statement Personal Financial Statement Financial Statement Analysis

Image Result For Cash Flow Statement Template Contents Cash Flow Statement Personal Financial Statement Financial Statement Analysis

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg) Financial Statements Definition

Financial Statements Definition

Earnings Before Interest Taxes And Other Earnings Before Metrics Metric Financial Statement Income Statement

Earnings Before Interest Taxes And Other Earnings Before Metrics Metric Financial Statement Income Statement

Statement Of Activity Statement Activities Finance

Statement Of Activity Statement Activities Finance

Activity Ratios Calculator Plan Projections Financial Analysis How To Plan Business Tools

Activity Ratios Calculator Plan Projections Financial Analysis How To Plan Business Tools

In This Activity Students Will Be Able To Practice Reconciling Their Checkbook Using A Check Register And A Bank State Checkbook Check Register Bank Statement

In This Activity Students Will Be Able To Practice Reconciling Their Checkbook Using A Check Register And A Bank State Checkbook Check Register Bank Statement

Business Activity Statement Tax An Australian Business Activity Tax Statement F Affiliate Tax Australian Statement Stock Photography Business Business

Business Activity Statement Tax An Australian Business Activity Tax Statement F Affiliate Tax Australian Statement Stock Photography Business Business

Statement Of Cash Flows Significant Non Cash Activities Cash Flow Statement Accounting Classes Bookkeeping Business

Statement Of Cash Flows Significant Non Cash Activities Cash Flow Statement Accounting Classes Bookkeeping Business

Last Date To Lodge Your Business Activity Statement For The January March Period Is 28th April 2015 Statement Last Date Activities

Last Date To Lodge Your Business Activity Statement For The January March Period Is 28th April 2015 Statement Last Date Activities