How Do You Register A Company With Sars

Before completing your ITR14 make sure that that the contact address banking and public officer details of the company are correct by verifying and updating it if required on the Registration Amendments and Verification Form RAV01. It can either be manually or electronically via the SARS eFiling system.

Tax Clearance Certificate New Compliance Pin With Sars Youtube

Tax Clearance Certificate New Compliance Pin With Sars Youtube

For the owners of private companies registering a new company through the CIPC website often leads to automatic SARS registration.

How do you register a company with sars. Employers must complete the forms for both themselves and their workers. Instead of going into a SARS Branch see which changes can be made via eFiling. Registering as an Employer.

Click SARS Registered details on the side menu 5. How to register for PAYE on eFiling. If you do not register for eFiling SARS will send you a.

After successfully completing it submit it to a SARS branch near you. Once youre on the site simply click Register Now to get started. Once youre registered SARS will automatically issue you with a tax reference number.

If you register your company in this way you will shortly receive an email from SARS informing you of your new company tax number. An individual if they are operating in their personal capacity. SARS cannot be held responsible for any errors or omissions in the information provided.

Unemployment Insurance UIF filing is done separately on wwwufilinggovza As with eFiling you can submit your UIF declarations and pay your contributions through this free service. Navigate to SARS Registered Details functionality. SARS intends to expand the services offered through eFiling substantially as the service matures Please note.

EFilers will register as Please select and click on the appropriate option below. For Employers - if you want to apply for registration of Payroll taxes. Should you need to register for tax manually with SARS you should use Form IT77C.

The Maintain SARS Registered Details screen will display. Select Notice of Registration 6. Select Maintain SARS Registered Details.

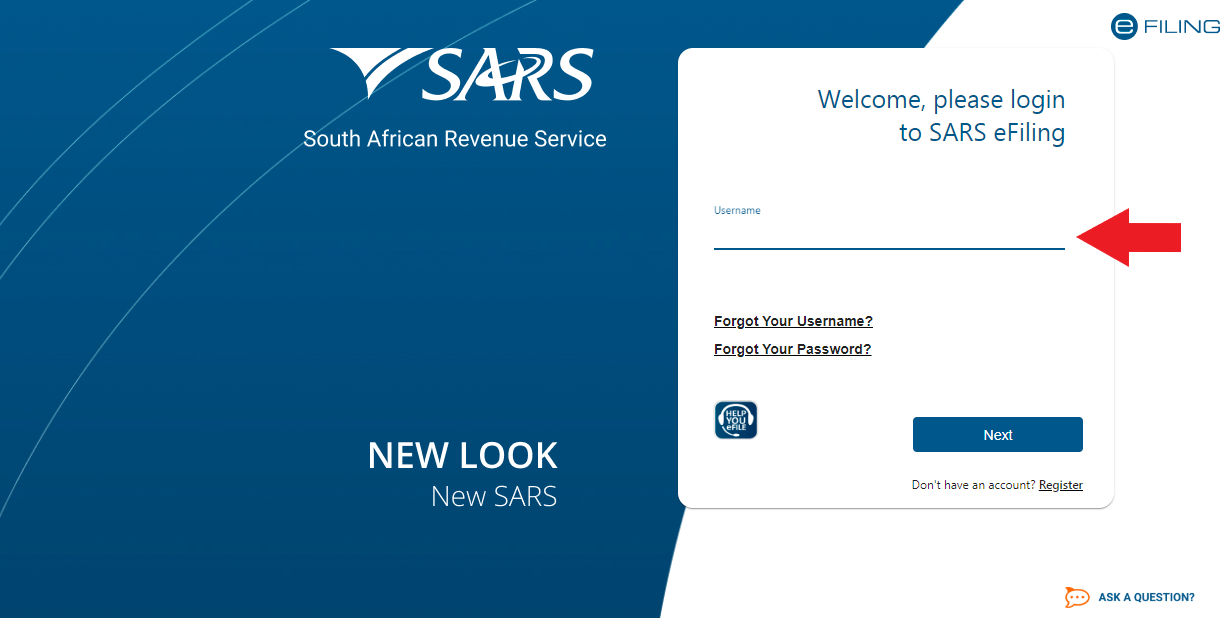

Get started by logging in. Type in your unique username and password - you will. All you need is internet access.

For CIPC registered companies you are not required to perform a separate SARS tax registration for Income Tax as your company will automatically be registered via a direct interface with CIPC. VAT vendors can also request and obtain a VAT Notice of Registration on eFiling. Complete the EMP101e Payroll taxes - Application for Registration taxes form.

Individuals partnerships trust funds foreign donor funded projects and municipalities. Keeping my business details up to date. For assistance in completing the form see the Guide for completion of Employer Registration application.

Well show you how to register a company profile on eFiling STEP 1. If you choose to do it manually you can download a VAT 101- Application for a Registration Form from the SARS website. You can register once for all different tax types using the client information system.

To complete the registration process you will need at hand. The term person is not limited to companies but also includes. The form for the registration of workers asks for an employer reference number.

Click on Register and from there you would be redirected to a new page. On the landing page there are three options available and so you would be required to choose the one that applies to you. You can register for this number in one of two ways.

Employers who do not have a reference number yet can leave this part open. Login to SARS eFiling 3. I acknowledge and have read and agree to the terms and conditions.

Complete the EMP101e Payroll taxes - Application for Registration taxes form. You can verify and update the RAV01 details by. Once you have your documents on the ground the following are the next steps to take.

The easiest way to register with SARS is to visit the eFiling website. Alternatively you can do this via MobiApp which can be downloaded on the Play Store or App Store. According to SARS you can register once for all different tax types using your client information system.

Once you have been registered for tax and given your tax number you can register for eFiling on wwwsarsefilingcoza and file income tax returns online when tax season starts. Visit the official website of SARS. Go to the Organizations main menu 4.

When the company has been registered with the CIPC the registrant must then register with SARS to receive an income tax reference number within 60. The UIF will create a reference number and send it to you. Select I Agree to confirm that you are authorised to perform maintenance functions of the.

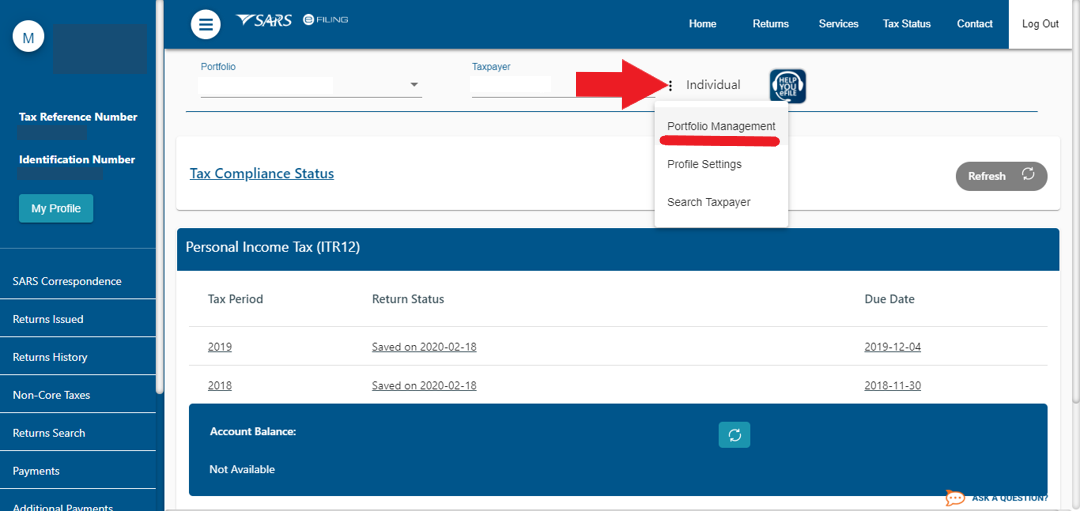

If youre an eFiler you will be able to change some your personal details via eFiling. Once youre are on the landing page click on the 3 three dots on top next to the word Individual. Your tax registration numbers.

Also ignore the part asking for a signature. Follow these easy steps. A company can be registered using Form IT77C.

Please note that by continuing to the next screen and accessing the VAT vendor search you indicate your awareness of and consent to the terms and conditions of the above statement.

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

Adding Clients To An Efiling Profile

Adding Clients To An Efiling Profile

Sars Mobiapp How To Register Youtube

Sars Mobiapp How To Register Youtube

Tax Clearance Certificate New Compliance Pin With Sars Youtube

Tax Clearance Certificate New Compliance Pin With Sars Youtube

How To Register For Paye On Efiling

How To Register For Paye On Efiling

Faq How Do I Activate A Tax Type On Efiling

Faq How Do I Activate A Tax Type On Efiling

How To Register For Vat On Efiling

How To Register For Vat On Efiling

Sars Efiling How To Submit Your Itr12 Youtube

Sars Efiling How To Submit Your Itr12 Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

Sars Efiling How To Register Youtube

Sars Efiling How To Register Youtube

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Access My Compliance Profile

How To Access My Compliance Profile

Sars Efiling How To Register As An Individual Individuality Registered Tutorial

Sars Efiling How To Register As An Individual Individuality Registered Tutorial

Faq Where Do I Find My Statement Of Account Itsa To See My Outstanding Balance

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling