How To Get 1099 Form From Unemployment

Once there you may be able to sign in to your account and view it or request another one be sent to you. Once the 2020 1099G forms are uploaded PUA claimants can access their PUA-1099G via their PUA Dashboard.

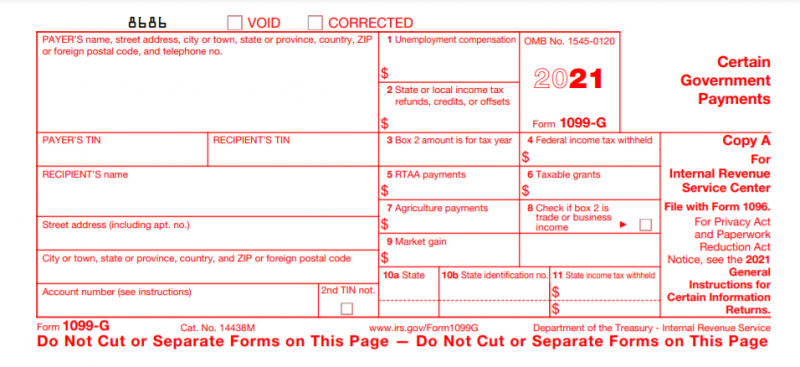

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile.

How to get 1099 form from unemployment. You will need this information when you file your tax return. Press 2 Individual. The most common use of the 1099-G is to report unemployment compensation as well as any state or local income tax refunds you received that year.

If you get a file. The Department of Unemployment Assistance DUA will mail you a copy of your 1099-G by Jan. If you would like to request an additional copy of your 1099-G form to be mailed to your address on file please contact 800 244-5631.

If you were a phone filer it will. The 1099G forms for Regular Unemployment Compensation UC is now available to download online. If you need a Form 1099-G for a year prior to 2009 please contact the Unemployment Hotline at 603 271-7700 and.

IDES mailed paper copies of the 1099-G form in January to all claimants who opted NOT to receive their form electronically. Follow the instructions to enter your unemployment. Look for the 1099-G form youll be getting online or in the mail.

If youve lost or cant find your 1099-G select your state below to go to your local unemployment website. To access this form please follow these instructions. The fastest way to receive a copy of your 1099-G Form is by selecting electronic as your preferred method for correspondence.

The Pandemic Unemployment Assistance PUA 1099G form will also be made available to download online. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form.

1099G is a tax form sent to people who have received unemployment insurance benefits. How to Get Your 1099-G online. These forms will be mailed to the address that DES has on file for you.

You can receive a copy of your 1099-G Form multiple ways. 31 of the year after you collected benefits. For Pandemic Unemployment Assistance PUA claimants the.

18 hours agoThe Colorado Department of Labor and Employment says the most important and first step to take if you receive an inaccurate 1099-G or Reliacard and never filed for unemployment is. These forms are available online from the NC DES or in the mail. On the row marked 2020 click View to open a.

The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. Unemployment is taxable income. From the Unemployment Insurance Benefits Online page below under the Get your NYS 1099-G section select the year you want in the NYS 1099-G drop-down menu box with an arrow and then select the Get Your NYS 1099-G button.

Go to Services for Individuals Unemployment Services and select Form 1099-G Information from the sub-navigation options presented. You may choose one of the two methods below to get your 1099-G tax form. The 1099G form reports the gross.

Remember even if you were unemployed you still have to file income taxes. You can log-in to CONNECT and go to My 1099- G in the main menu to view the last five years of your 1099-G Form document. Follow the prompts to schedule a callback.

Form 1099-Gs issued from 2009 through 2019 are available online by logging into the unemployment benefit system and going to your correspondence box. The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year. You can also download your 1099-G income statement from your unemployment benefits portal.

When you apply for unemployment insurance benefits you can choose to have 10 of your weekly benefit amount withheld for federal income taxes andor 6 for state income taxes.

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

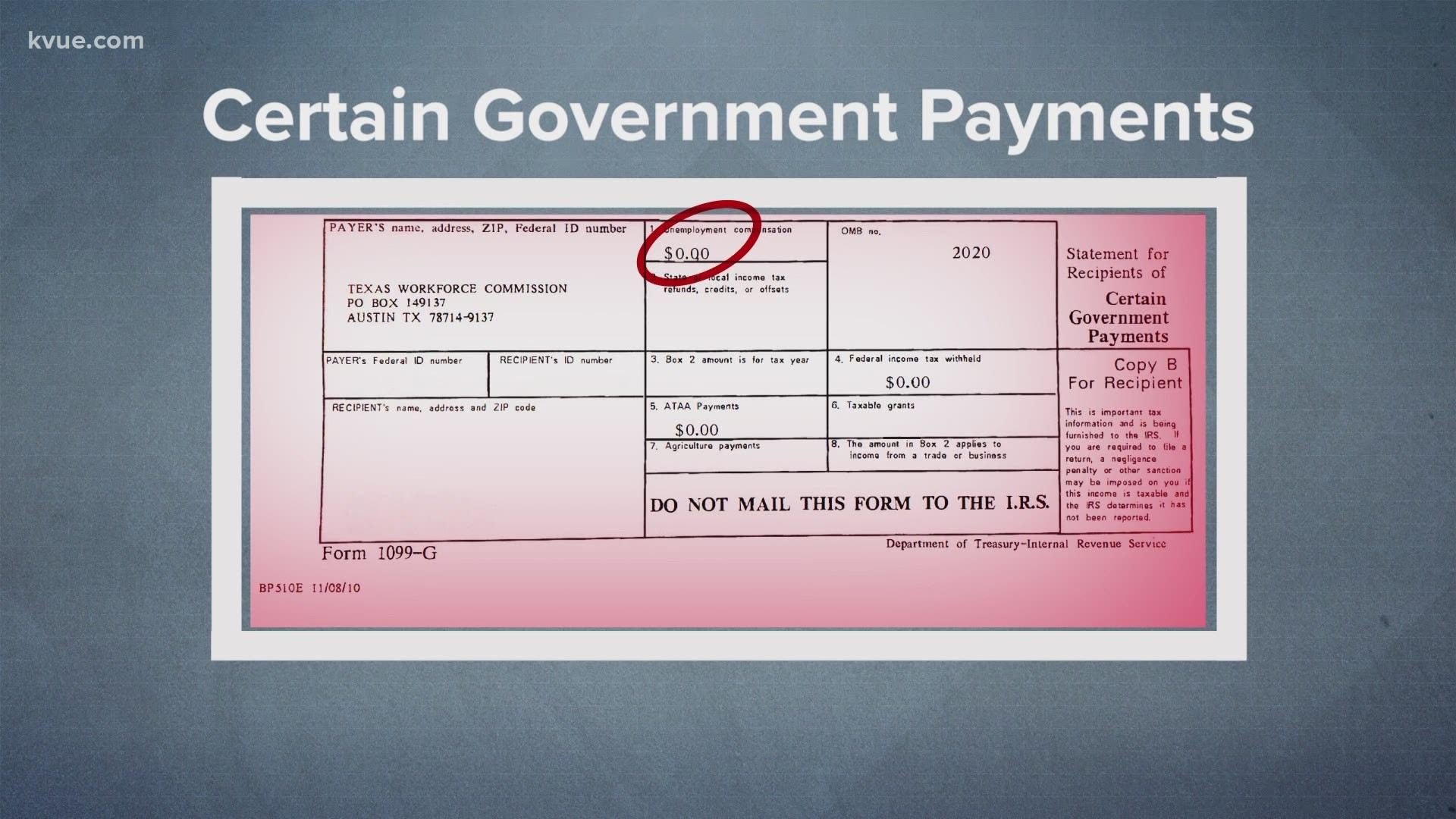

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

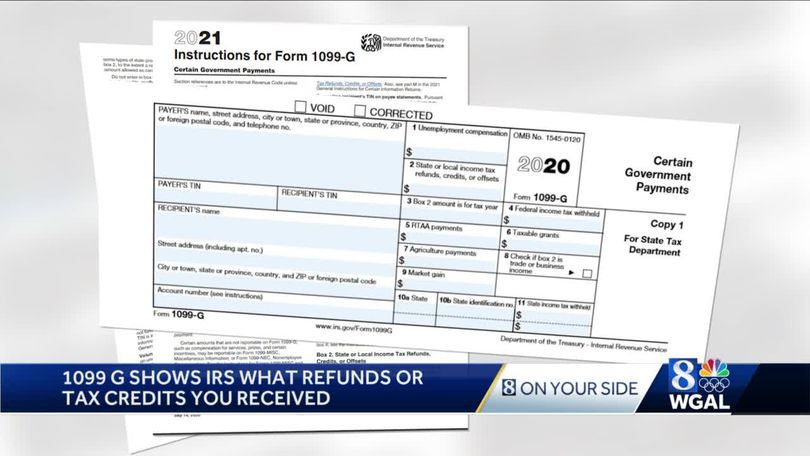

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It