How To Get 1099 G Form Virginia

You may access your IRS Form 1099-G for UI Payments for current and previous tax years on MyUI portal by entering your social security number and four-digit personal identification number PIN. How to Get Your 1099-G online.

Unemployment 1099 G Form Page 1 Line 17qq Com

Unemployment 1099 G Form Page 1 Line 17qq Com

You may download a copy of your current IRS Form 1099-G through your online account at desncgov at no charge.

How to get 1099 g form virginia. After each calendar year during which you get Unemployment Insurance benefits we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. If you choose this option it could take several days to receive your form in. To access this form please follow these instructions.

Request Your 1099 By Phone To request a copy of your 1099-G or 1099-INT by phone please call 304 558-3333. If 760PY return add both columns of line 1. If there is a problem with your PIN you can also access your form by selecting IRS Form 1099-G for UI Payments then enter other credentials.

The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. To look up your Form 1099-G1099-INT online youll need the following information from your most recently filed Virginia tax return. Your adjusted gross income Line 1 If you filed a part-year return add together the amounts from both columns Line 1.

If you filed a part-year return add together. Once there you may be able to sign in to your account and view it or request another one be sent to you. Instructions for the form can be found on the IRS website.

Mail the completed form to. Click here for the Request for Change in Withholding Status form. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays.

You may choose one of the two methods below to get your 1099-G tax form. If joint return filed for tax. To look up your 1099GINT youll need your adjusted gross income from your most recently filed Virginia income tax return Line 1 or the sum of both columns of Line 1 for a part-year return.

I decided to try and get a jump on my taxes this year and I need the 1099G form in order to complete them. This information is also sent to the IRS. Does anyone know if i need to file the 1099-g form if i did not have taxes taken out of my unemployment.

I guess Im wondering if anyone else has received their 1099G form and if I really need it. Virginia Relay call 711 or 800-828-1120. 1099-Gs for years from 2018 forward are available through your online account.

According to its weekly update the Department of Economic Opportunity says it. To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link. You can also use Form 4506-T to request a copy of your previous years 1099-G.

Many of you are wondering where to get your 1099-G form. You can download Form 4506-T at IRSgov or order it from 800-TAX-FORM. Contact the IRS at 800-829-1040 to request a copy of your wage and income information.

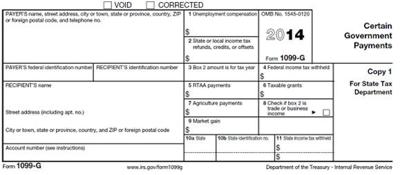

The 1099-G tax form is commonly used to report unemployment compensation. Request Your 1099 By Phone To request a copy of your 1099-G or 1099-INT by phone please call 304 558-3333. This is the fastest option to get your form.

To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link. When I first applied for UI I selected to have my taxes withdrawn from the pay. Written requests for a hard copy of your 1099-G form from 2018 2019 2020 or 2021 may be.

Virginia How do I obtain my 1099-G form for receiving unemployment in 2020. Line 1 Adjusted Gross Income from your last filed 760 760PY or 763 Virginia return. This is the fastest option to get your form.

Follow the instructions to enter your unemployment. Virginia Original Poster 2 months ago. This 1099-G does not include any information on unemployment benefits received last year.

1099-G Tax Form Published on Virginia Employment Commission httpswwwvecvirginiagov 1099-G Tax Form 1 The 1099-G tax form is commonly used to report unemployment compensation. If you choose this option it could take several days to receive your form in. If youve lost or cant find your 1099-G select your state below to go to your local unemployment website.

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

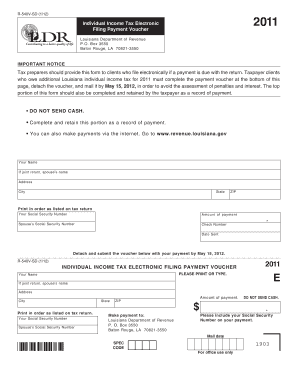

1099 G Louisiana Fill Online Printable Fillable Blank Pdffiller

1099 G Louisiana Fill Online Printable Fillable Blank Pdffiller

1099 G Form Copy B Recipient Discount Tax Forms

1099 G Form Copy B Recipient Discount Tax Forms

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Check Out This Overview Of 2020 Income Tax Documents And Common Mistakes To Help You Betaxprepsmart Federal Income Tax Tax Refund Money Smart Week

Check Out This Overview Of 2020 Income Tax Documents And Common Mistakes To Help You Betaxprepsmart Federal Income Tax Tax Refund Money Smart Week

Explore Our Sample Of Direct Deposit Sign Up Form Social Security For Free Social Security Certificate Of Deposit Deposit

Explore Our Sample Of Direct Deposit Sign Up Form Social Security For Free Social Security Certificate Of Deposit Deposit

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Income Ta Tax Forms The Secret Book Payroll Checks

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Income Ta Tax Forms The Secret Book Payroll Checks

Michigan 1099 G Form 2017 Vincegray2014

Michigan 1099 G Form 2017 Vincegray2014

1099 G Form Copy A Federal Discount Tax Forms

1099 G Form Copy A Federal Discount Tax Forms

Wv Tax Department No Longer Sending 1099s Business Wvgazettemail Com

Wv Tax Department No Longer Sending 1099s Business Wvgazettemail Com

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 G Form Copy C State Discount Tax Forms

1099 G Form Copy C State Discount Tax Forms

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

How To Avoid An Irs Audit Debt Relief Programs Irs Credit Card Relief

How To Avoid An Irs Audit Debt Relief Programs Irs Credit Card Relief

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Unemployment Fraud Causes Issues With 1099 G Forms For Kansans

Unemployment Fraud Causes Issues With 1099 G Forms For Kansans

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block