Vermont Business Tax Registration

Welcome to the Vermont Department of Labors Employer Registration Application. Tax Department Reminds Vermonters to File Property Tax Credit and Renter Rebate Claims August 19 2020 Economic Recovery Grant Program Award Maximum Increased for the Vermont Business Sectors Most Impacted By COVID-19.

Form An Llc In Virginia How To Start An Llc Kentucky Llc Virginia

Form An Llc In Virginia How To Start An Llc Kentucky Llc Virginia

Certified Record Request.

Vermont business tax registration. Submit Your Payment by Mail. Advanced Search I would like to search by. Businesses and nonprofits must register for a Vermont Business Tax Account and license before collecting Vermont tax.

Business Start-Up Guide Step-by-step guide and resources for starting a new business in Vermont. Vermont Department of Taxes 133 State Street 1st Floor Montpelier VT 05633-1401. VT Department of Tax.

If your business will be collecting Vermont Sales and Use Tax you are required to apply for a license. To 430 pm Monday through Friday. Show me similar sounding business names.

Start or Register Your Business. Register a Business There are three main resource websites to register your business in Vermont and the information on these websites is easily accessed and designed to be helpful for all types of businesses. From profit corporations to LLCs and Limited Partnerships you.

Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont. Business Tax Center Find guidance on paying taxes as a business in Vermont. Complete a Vermont Registration Tax and Title application VD-119 and submit it together with the above documentation and the appropriate fees to the Vermont Department of Motor Vehicles.

How to Get an EIN Number in Vermont. Please allow 7-10 business days for the processing of any filings received by mail. Do not invest in websites signs business cards or other marketing materials until you receive a certificate confirming the availability and your ownership of the requested name.

Depending on your business type it may be necessary to register with the US Internal Revenue Service. While the process of applying for an EIN is simple many people still feel overwhelmed when it comes to understanding exactly what it is. This is different from a File Number.

Pass-through entities including S-Corporations Partnerships and LLCs that elect to be taxed as Partnerships or S-Corps are subject to Vermonts business incomebusiness entity tax laws and provisions and file Form BI-471 Business Income Tax Return and related schedules. Download the PDF form to your computer and then open it with Adobe Reader. The first step is selecting your business type.

Business Tax Center Find guidance on paying taxes as a business in Vermont. Vermont businesses including nonprofits must register for a Vermont Business Tax Account and license prior to collecting the tax. Corporations Business Services.

There is no extra fee for online filing. We have designed this application in two steps to determine if registration is necessary at this time. Vermont Department of Taxes PO Box 1779 Montpelier VT 05601-1779.

Business Start-Up Guide Step-by-step guide and resources for starting a new business in Vermont. NAICS Codes or Business Purpose Descriptions may not be available for all entity types. If mailing your return with a payment mail to.

Online filing normally takes less than 1 business day. Additionally you may wish to consult with an attorney and an accountant when registering. Apply for a License to Collect.

One of your legal obligations as a small business in Vermont is to get an EIN. Please include your Business Tax Account number. Our office hours are 745 am.

This initial page will make a preliminary determination on whether or not you are providing employment covered under the Vermont unemployment compensation program. Register a Business in Vermont Step 1. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont.

VT Department of Labor. Before You Open for Business. Depending on your business.

Weve compiled this guide to help you understand what the EIN is why you need one and how to get one in Vermont. Online registration is the preferred method.

How To Register A Company In Dubai Dubai Company Registration Companies In Dubai Dubai Company

How To Register A Company In Dubai Dubai Company Registration Companies In Dubai Dubai Company

S F Consulting Firm Limited Company Registration Expert Consulting Firms Accounting Services Public Company

S F Consulting Firm Limited Company Registration Expert Consulting Firms Accounting Services Public Company

How To Register A Business Name In Vermont How To Start An Llc

How To Register A Business Name In Vermont How To Start An Llc

Register For A Sales Tax Permit In The State Of Virginia Business Solutions Virginia Sales Tax

Register For A Sales Tax Permit In The State Of Virginia Business Solutions Virginia Sales Tax

Vermont Llc How To Form An Llc In Vermont Truic Guides

Vermont Llc How To Form An Llc In Vermont Truic Guides

Michigan Foreign Llc Registration File A Michigan Certificate Of Authority

Incorporate In Hawaii Do Business The Right Way

Florida Foreign Llc Registration Get A Florida Certificate Of Authority

How To Choose Between Bonds Cds And Savings Accounts Family Money Saving Business Tax Economy Infographic

How To Choose Between Bonds Cds And Savings Accounts Family Money Saving Business Tax Economy Infographic

How To Form An Llc In California Startingyourbusiness Com

How To Form An Llc In California Startingyourbusiness Com

How To Search Available Business Names In Vermont Startingyourbusiness Com

How To Search Available Business Names In Vermont Startingyourbusiness Com

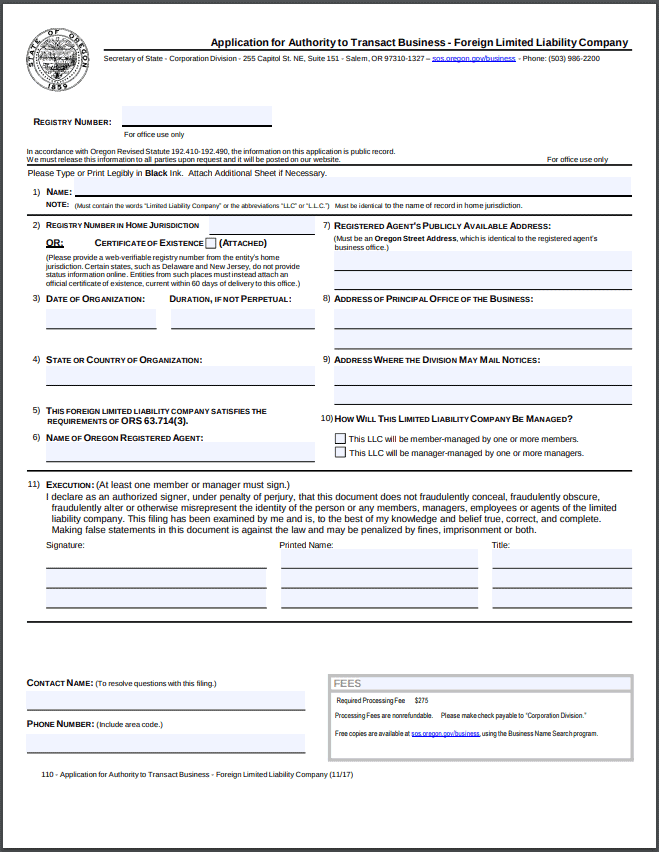

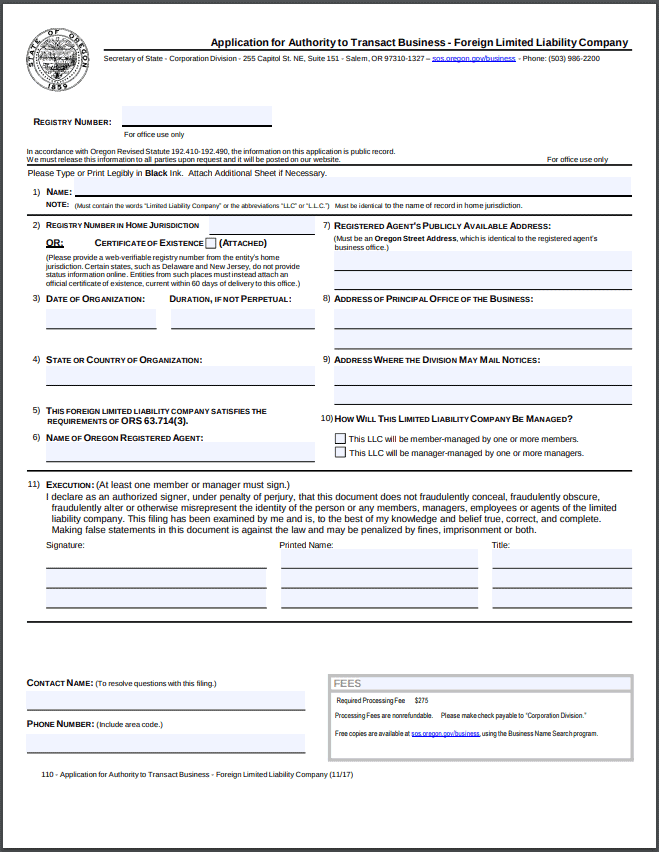

Oregon Foreign Llc Registration Get An Oregon Certificate Of Authority

Oregon Foreign Llc Registration Get An Oregon Certificate Of Authority

Georgia Foreign Llc Registration Get A Georgia Certificate Of Authority

Ohio Foreign Llc Registration Get An Ohio Certificate Of Authority

Stumped How To Form A West Virginia Llc The Easy Way

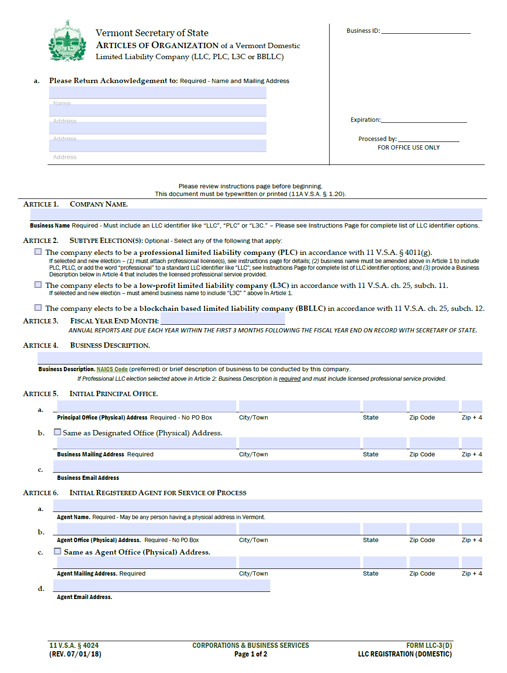

Incorporate In Vermont Do Business The Right Way

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Office Web

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Office Web

Best New Car Lease Deals Incentives 289 A Month Including Tax Lic And Fees Contact Mike Jaimes 213 909 6020 Car Lease Best New Cars Lease Deals

Best New Car Lease Deals Incentives 289 A Month Including Tax Lic And Fees Contact Mike Jaimes 213 909 6020 Car Lease Best New Cars Lease Deals

West Virginia Foreign Llc Registration Get Your Certificate Of Authority