Simplified Method To Calculate Business Use Of Home

If you meet the criteria above youll have two choices for calculating the deduction. This method can only be used for the 2020 tax year.

How To Fill Out The Schedule C Expenses

How To Fill Out The Schedule C Expenses

If all gross income from the trade or business is from this qualified business use of home compute.

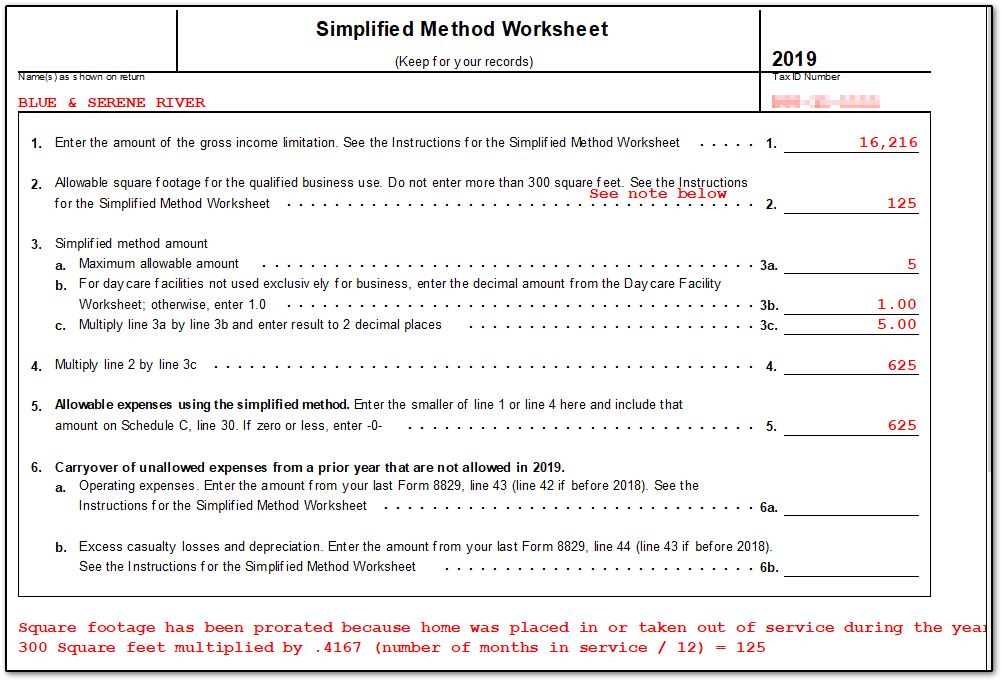

Simplified method to calculate business use of home. Jul 04 2020 Under this simplified option you multiply a prescribed rate by the allowable square footage of the office in lieu of determining actual expenses. The simplified method and the actual expense method. Aug 28 2020 When you use the simplified method you will deduct this amount instead of calculating the direct and indirect expenses related to your in-home business things like mortgage interest repairs insurance utilities etc.

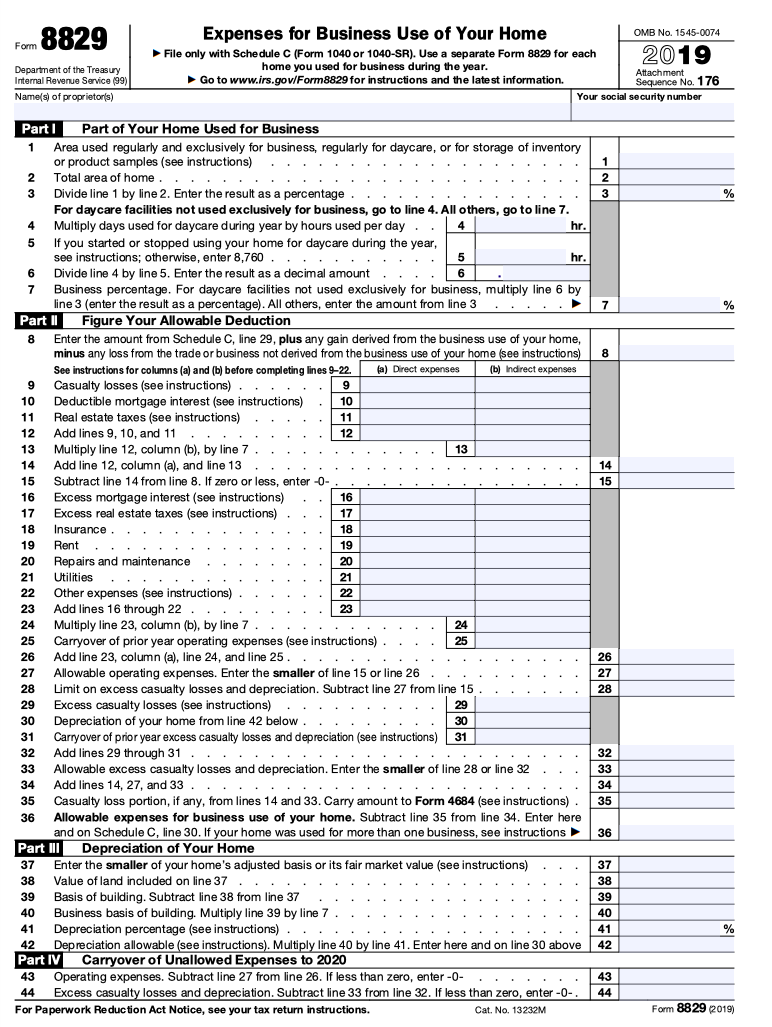

Refer instruction for form 8829 What is Regular Method. Under the simplified method youll receive a deduction of 5 per square feet of home office space with a maximum of 300 square feet. 9 rows Mar 12 2021 Beginning in tax year 2013 returns filed in 2014 taxpayers may use a simplified option when.

Itemize Home Office Expenses. If you select Improvements the field in the Improvements group box becomes available. Under this new method employees will not have to get Form T2200 or Form T2200S completed and signed by their employer.

You can deduct 5 for every square foot of your home office up to a maximum of 1500. Jul 18 2017 If your home office is 300 square feet or less the IRS has an optional simplified method of calculating your home office deduction. This means you do not have to.

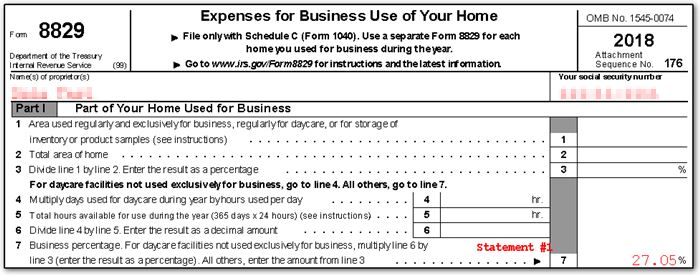

The regular method involves adding up the total expenses of maintaining your home for the year and multiplying them by the percentage of your home used for business. For tax year the prescribed rate is 5 per sq ft area of the office and maximum area of home office allowable is 300 sqft. If not electing to use the simplified method use Form 8829 Expenses for Business Use of Your Home.

Type of home office asset. The simplified method as announced in Revenue Procedure 2013-13 PDF is an easier way than the method provided in the Internal Revenue Code the standard method to determine the amount of expenses you can deduct for a qualified business use of a home. Dec 15 2020 A new temporary flat rate method will allow eligible employees to claim a deduction of 2 for each day they worked at home in that period plus any other days they worked from home in 2020 due to COVID-19 up to a maximum of 400.

Working from home Calculate your allowable expenses using a flat rate based on the hours you work from home each month. What is the simplified method for determining the home office deduction. The simplified method takes the square footage of your home office with a maximum of 300 square feet and multiplies it by a rate prescribed by the IRS.

Jan 05 2020 Home Business Space Deductions - Two Options The regular calculation method includes making a detailed list of home expenses. However the IRS does not require any specific method for calculating as long as the percentage of use is accurately reported. Use this worksheet to compute the amount of expenses the taxpayer may deduct for a qualified business use of a home if electing to use the simplified method for that home.

This number should only. Select the home office asset type from the drop-down list and press TAB. In most cases the area method is the best since most homes do not have rooms of equal size.

Divide the number of rooms used for business by the total number of rooms in the home use this method if the number of rooms is about the same. The rate for 2019 is 5 per square foot. For example if your home office is 200 square feet youll get a 1000 deduction.

This means multiple people working from the same home can each make a claim. For example say your home is 1200 square feet in total and you use 100 square feet 8 for your home office. Each individual working from home who meets the eligibility criteria can use the temporary flat rate method to calculate their deduction for home office expenses.

The simplified calculation just multiplies the amount of space by a specific square foot amount up to a maximum. Area of Home Used for Business - The easiest method for calculating this area is to use the square footage method. Jan 05 2020 Number-of-Rooms Method.

If you select Home the fields in the Business use of a home and Allowable deductions group boxes become available. Aug 12 2019 The simplified method lives up to its namesake by offering an easier and simpler way to calculate the home office tax deduction.

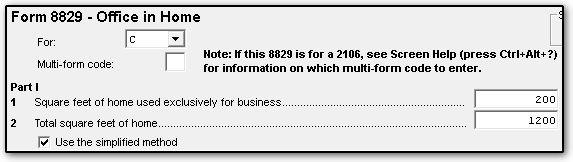

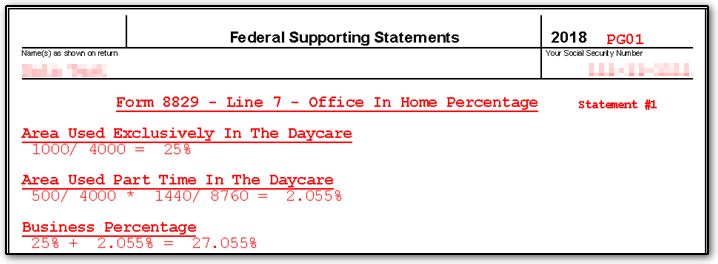

How Does Form 8829 Office In Home Function In Drake Tax

How Does Form 8829 Office In Home Function In Drake Tax

Standard Home Office Vs Actual Expenses What S Better

Standard Home Office Vs Actual Expenses What S Better

Home Office Deduction Worksheet Excel

Home Office Deduction Worksheet Excel

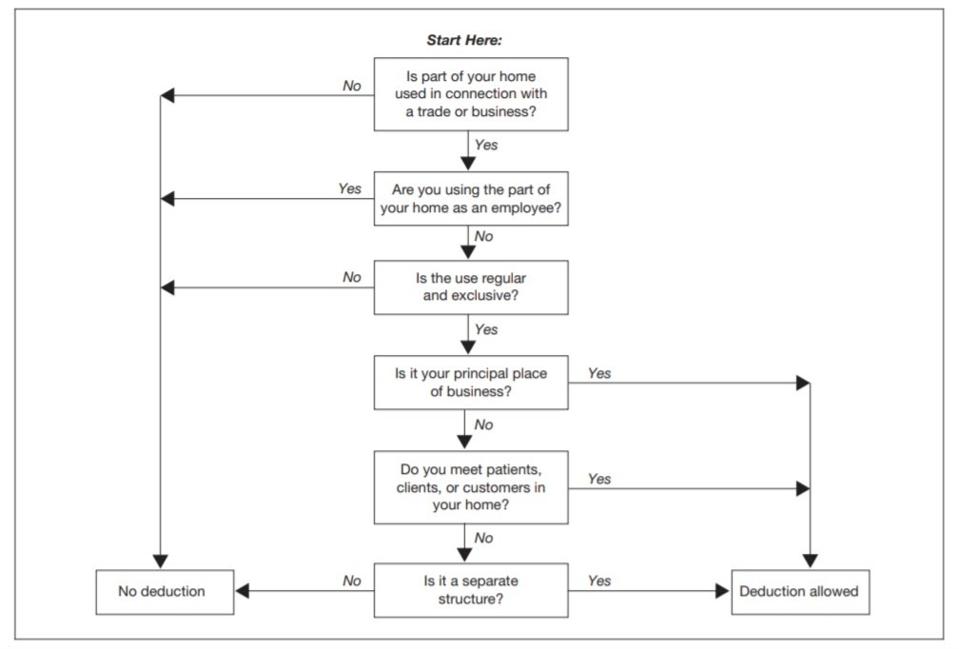

.png) Quiz Do I Qualify For The Home Office Deduction

Quiz Do I Qualify For The Home Office Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

8829 Simplified Method Schedulec Schedulef

8829 Simplified Method Schedulec Schedulef

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg) 15 Tax Deductions And Benefits For The Self Employed

15 Tax Deductions And Benefits For The Self Employed

How To Avoid Paying Taxes On 1099 Misc

How To Avoid Paying Taxes On 1099 Misc

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

8829 Simplified Method Schedulec Schedulef

8829 Simplified Method Schedulec Schedulef

Home Office Tax Deductions Faqs Bench Accounting

Home Office Tax Deductions Faqs Bench Accounting

Standard Home Office Vs Actual Expenses What S Better

Standard Home Office Vs Actual Expenses What S Better

8829 Simplified Method Schedulec Schedulef

8829 Simplified Method Schedulec Schedulef

Home Office Deduction Worksheet Excel

Home Office Deduction Worksheet Excel

How Does Form 8829 Office In Home Function In Drake Tax

How Does Form 8829 Office In Home Function In Drake Tax

Http Www Thetaxbook Com Updates Thetaxbook Client 20tax 20tools Business Use Of Home Simplified Method Worksheet Pdf

8829 Simplified Method Schedulec Schedulef

8829 Simplified Method Schedulec Schedulef

Publication 583 01 2021 Starting A Business And Keeping Records Internal Revenue Service

Publication 583 01 2021 Starting A Business And Keeping Records Internal Revenue Service

How To Fill Out Form 8829 Bench Accounting

How To Fill Out Form 8829 Bench Accounting