Do I Need To File Schedule K-1 With Form 1065

Partners are not employees and shouldnt be issued a Form W-2. The partnership files a copy of Schedule K-1 Form 1065 with the IRS to report your share of the partnerships income deductions credits etc.

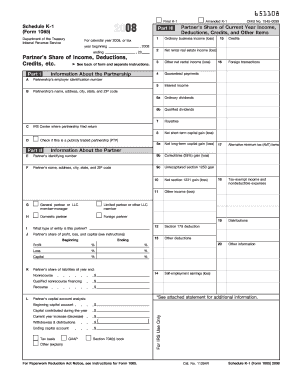

2008 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2008 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

But one-member LLCs must report as if they were a sole proprietorship using Schedule C.

Do i need to file schedule k-1 with form 1065. Yes unfortunately you need to file the amended return to report the K-1 you received. Heres where to send the different K-1 forms. As a result the partnership must prepare a Schedule K-1 to report each partners share of these tax items.

Youll fill out Schedule K-1 as part of your Partnership Tax Return Form 1065 which reports your partnerships total net income. When an LLC has more than one member the IRS considers it as a partnership. Schedule K-1 Form 1065 yangq You do not need to report the 0s or create a K-1 for an entity with a 0 in box 2 or 3.

The custodian of your IRA is required to file the form for you but you must submit the K-1 forms to them - ask the custodian about this. Information about Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc including recent updates related forms and instructions on how to file. I received my Schedule K-1 Form 1065 after I filed my taxes but there was no gainloss.

The partnership as an entity may need to file the forms below. At the same time the company must also issue K-1 schedules for each partner. Return of Partnership Income is used to help report a gain or loss in partnership business on each partners Schedule K-1.

Return of Partnership Income including recent updates related forms and instructions on how to file. The partnership must furnish copies of Schedule K-1 Form 1065 to the partner. The tax form reports the participation of each member in the business income deductions and tax credit items.

Return of Partnership Income. Certain partnerships with more than 100 partners are required to file Form 1065 Schedules K-1 and related forms and schedules electronically. For example imagine that LJM Consulting LLC is a consulting firm formed by Larry Jim and Mike.

Unrelated Business Income is reported as code V in box 20 on the K-1 form. The Schedule K-1 that goes from an S corporation to you is Form 1120-S unlike the Schedule K1 1040 document. Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS.

Do I need TurboTax Premier to file Schedule K-1 Form 1065. LJM Consulting LLC uses Form 1065 to report its. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the US.

Each partner is responsible for filing an individual tax return reporting their share of income losses tax deductions and tax credits that the business reported on the informational 1065 tax form. You can file your Schedule K-1 form when you submit your Form 1065 or 1120S to the IRS. Yes you can continue to use the Guide Me interview to enter your Schedule K-1.

IRS Form 1065 is five pages long. For tax years beginning after July 1 2019 a religious or apostolic organization exempt from income tax under section 501d must file Form 1065 electronically. Or getting income from US.

As a partnership the company must file its IRS Form 1065 before March 15 of the next year although it can file for a six-month extension. These companies should file their taxes using Form 1065 along with the corresponding Schedule K-1. What do I do.

If Box E lists your Social Security Number then yes this Schedule K-1 must be included on your tax return. Partnerships use Form 1065B. Schedule K-1 Form 1065 is used for reporting the distributive share of a partnership income.

For deadlines see About Form 1065 US. The K-1 that the company sends you will tell you that interest income goes on line 8a dividends go on line 9a and 9b and so forth. The IRS will be looking for the K-1 on your return.

Also see pub 598. Learn more about the Form 1065 here. But the partnership still files its own return for information purposes Form 1065.

The easiest thing to do is to submit the form electronically by using IRS Free File or tax prep software. It is not reported on your tax return but on a 990-T form. This gives each partner around one month to file their own forms before the April 15 deadline for personal tax returns.

Both forms are statements of income expenses deductions and credits. If Box E lists the Identifying Number of your IRA fund then no do not include this Schedule K-1 on your tax return. You can also file the form by mail.

To file your taxes you must submit Form 1065 and Schedule K-1. How is IRS Form 1065 is Used. Annual Return of Income.

Information about Form 1065 US. Say Thanks by clicking the thumb icon in a post. What is Form 1065.

Homework 10 Instruction Comprehensive Problem 10 1 Chegg Com

Homework 10 Instruction Comprehensive Problem 10 1 Chegg Com

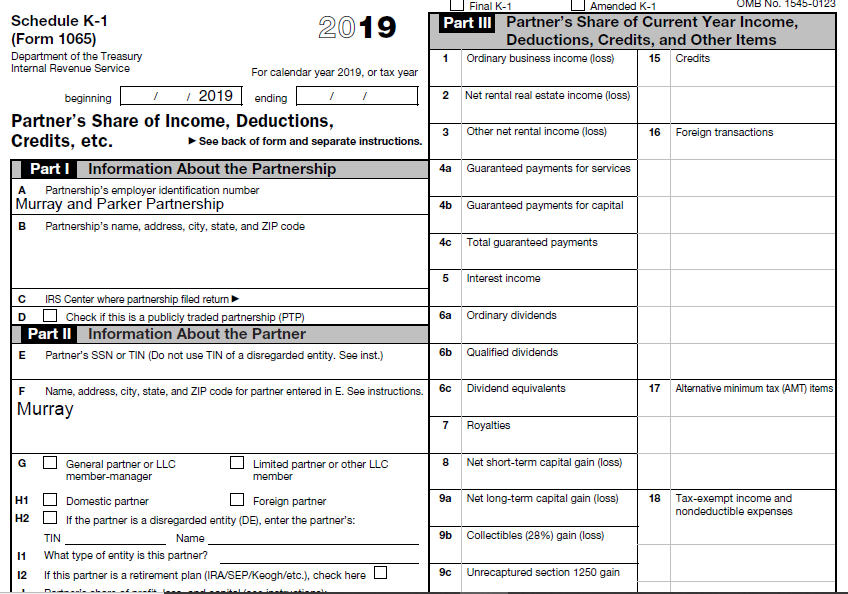

Solved Based Only On The Example Provided Fil Out The Fo Chegg Com

Solved Based Only On The Example Provided Fil Out The Fo Chegg Com

Partner S Instructions For Schedule K 1 Form 1065 Stambaugh Ness

Partner S Instructions For Schedule K 1 Form 1065 Stambaugh Ness

Form 1065 Schedule K 1 Partner S Share Of Income Deductions Credits Etc

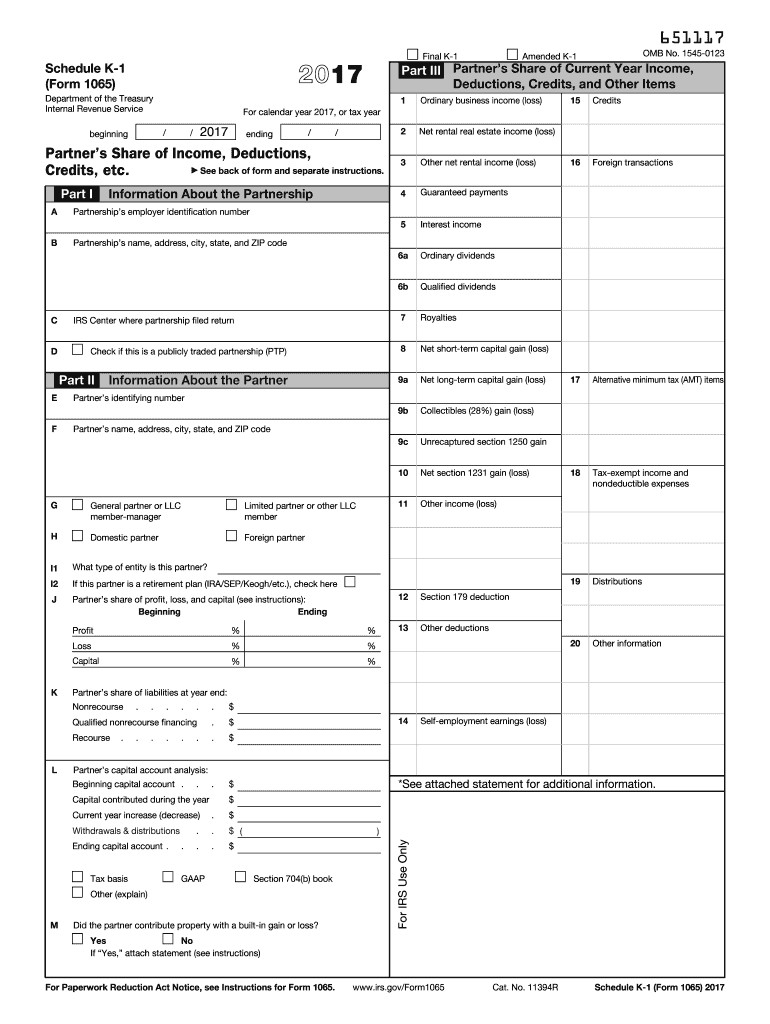

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

2008 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2008 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

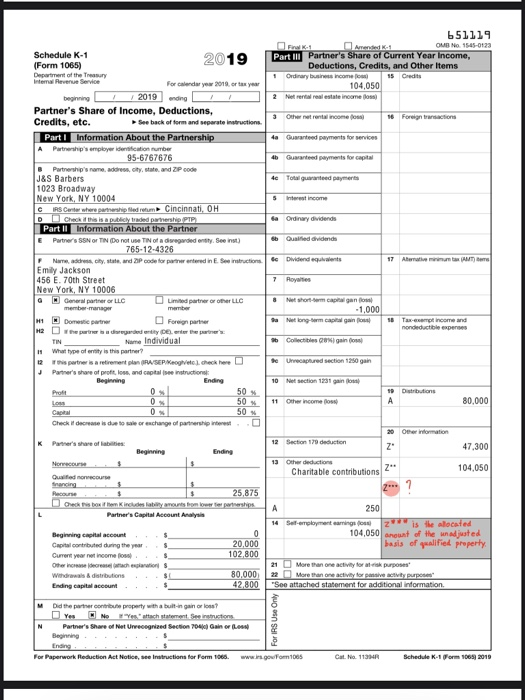

Irs Releases Draft 2019 Forms 1065 1120 S And Schedules K 1 E File Group Professional Tax Services Software

Irs Releases Draft 2019 Forms 1065 1120 S And Schedules K 1 E File Group Professional Tax Services Software

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Understanding The 1065 Form Scalefactor

Understanding The 1065 Form Scalefactor

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool