West Virginia State Tax Department Business Registration Certificate Search

West Virginia AMBER Alerts Receive AMBER Alerts on missing children based on your state of residence. Business activity is broadly defined to include all purposeful revenue-generating activity engaged in or caused to be engaged in with the object of gain or economic benefit either direct or indirect and all activities of this state and.

Business Registration Certificate

Business Registration Certificate

304 558-0900 Toll Free.

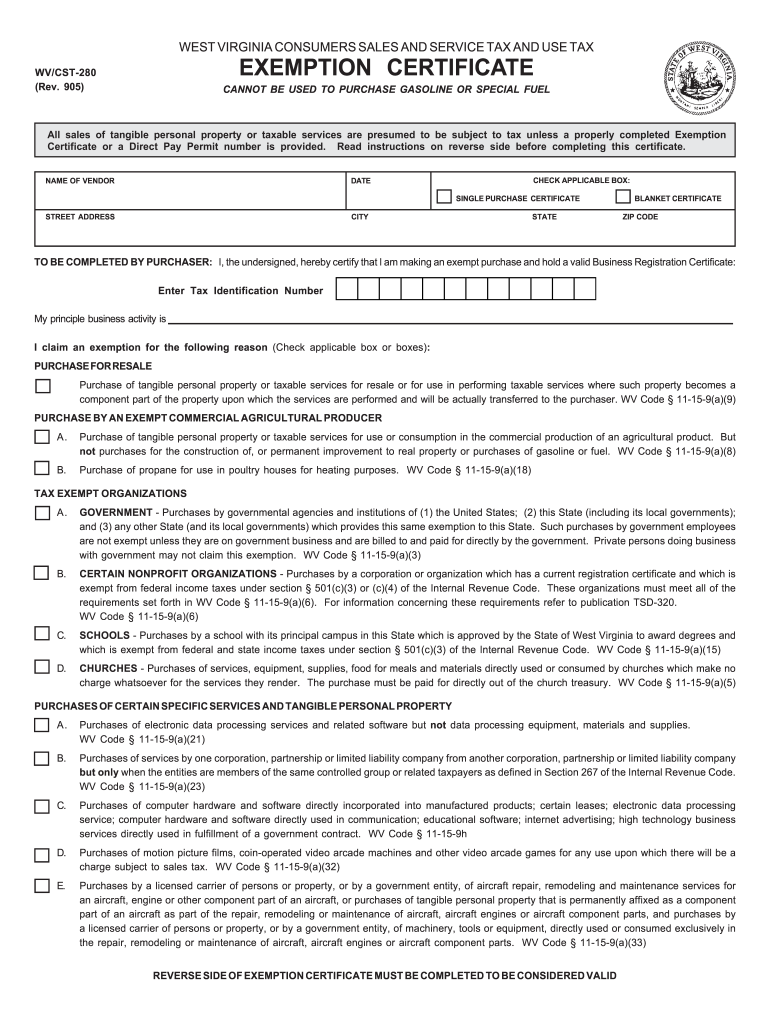

West virginia state tax department business registration certificate search. The State Tax Department issues permanent business registration licenses. Before engaging in business activity in West Virginia every individual or business entity must obtain a West Virginia business registration certificate from the State Tax Department. Monday - Friday 830 AM to 500 PM Phone.

Tax Credits - Visit the West Virginia Department of Commerce to learn more about various tax. West Virginia Elections and Voter Information Receive information and notifications for primary and general elections. A vendor is required to be in good standing in order to be able to bid and be awarded contracts by the State of West Virginia.

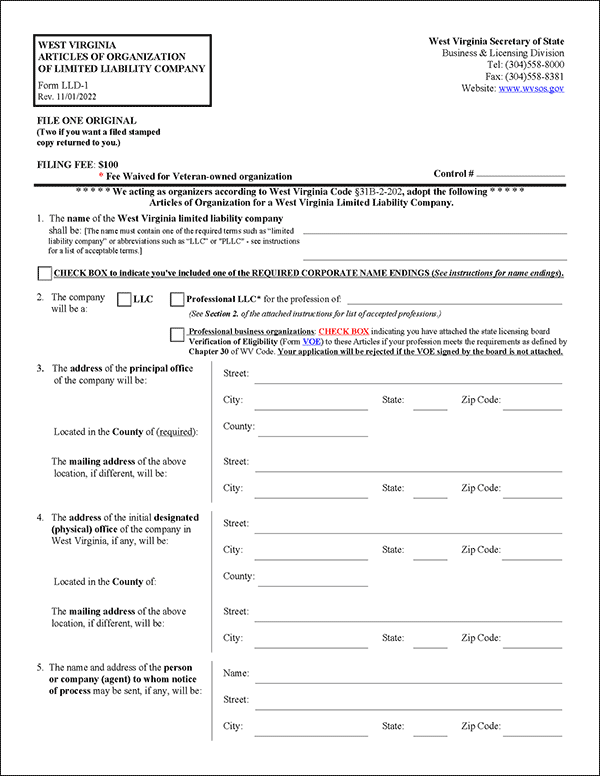

The West Virginia Office of Business Registration paper application Form WVBUS-APP is the primary form provided by that agency to apply for the Business Registration Certificate. West Virginia County and State Taxes This service reminds you when your countystate tax payments and assessments are due. Business activity is broadly defined to include all purposeful revenue-generating activity engaged in or caused to be engaged in with the object of gain or economic benefit either direct or indirect and all activities of this state and.

866 767-8683 Investigations Hotline. West Virginia Code requires each of these types of changes to be filed with the Secretary of State. For more information relating to all state tax registrations such as sales and use license severance gasoline withholding and much more visit the West Virginia State Tax Department Business Registration.

I would like to Search Byenter information in one field below. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs. View the information below to learn more about State Tax Department filing requirements and filing due dates.

Federal Employer Identification Number FEIN - Register with the IRS for the FEIN using IRS Form SS-4 or apply online. When you enter a business entity name and click the search button you will receive entity names that match your search criteria along with entity type city and status. This service will enable you to view registration information on West Virginia corporations and other business types which file with the Secretary of State.

Before engaging in business activity in West Virginia every individual or business entity must obtain a West Virginia business registration certificate from the State Tax Department. Department of Highways Alcohol Beverage Control Administration. To do so file the BRT 801-A Re-issuance of Business Registration Certificate form located here along with the 3000 Business Registration Renewal fee if applicable.

Taxwvgov West Virginia Business Registration Information and Instructions 3 HOW DO I REGISTER. The business registration certificate issued by the Tax Commissioner constitutes notice that the transient vendor named in the certificate has registered with the Tax Commissioner. West Virginia State Tax Department PO Box 2666 Charleston West Virginia 25330-2666.

Forms are available online through the Secretary of State Form Search. Application for Name Reservation - Reserve for a period of 120 days through the Secretary of Sate the business name you want to use when registering a business formed or qualified through the Secretary of States Office. A business is required to obtain a letter of good standing before dissolution or withdrawal from the State of West Virginia.

State Corporation Commission Clerks Information System. View the information below to learn more about tax credits filing requirements and filing due dates. By registering with the West Virginia Secretary of State the business will also be registering with the State Tax Department.

A transient vendor must keep the business registration certificate in his or her possession at all times when conducting business within this State. However each business is required to complete tax filings by specific due dates determined by the State Tax Calendar for specific filing submissions. Select Details to view additional information including full address registered number entity.

Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs. Visit the State Tax Department Business Registration section online for more information about filing changes to the business registration.

Every business operating in the state is required to register with the West Virginia State Tax Department to obtain a Business Registration Certificate and maintain tax filing compliance in the state. To register with the West Virginia State Tax Department you must complete the Application for Registration Certificate Form WV BUS-APP in this booklet and return to. To obtain a West Virginia Business Registration Certificate contact the West Virginia Secretary of State or the West Virginia State Tax Department.

Be sure to mark the Business Name andor Location Address Change box on page one of the form and provide the correct information on page two of the form. Basic Forms for Registering a Business in West Virginia. Office of the Secretary of State State Capitol Building Charleston WV 25305.

Wv Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Wv Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Incorporate In West Virginia Do Business The Right Way

How To Get A Certificate Of Exemption In West Virginia Startingyourbusiness Com

How To Get A Certificate Of Exemption In West Virginia Startingyourbusiness Com

Wv Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Wv Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Where S My Refund West Virginia H R Block

Where S My Refund West Virginia H R Block

Wv First State To Launch New Covid 19 Vaccine Pre Registration Tool Wvns

Wv First State To Launch New Covid 19 Vaccine Pre Registration Tool Wvns

West Virginia State Tax Information Support

West Virginia State Tax Information Support

West Virginia Llc How To Form A West Virginia Llc Truic Guides

West Virginia Llc How To Form A West Virginia Llc Truic Guides

Https Budget Wv Gov Executivebudget Documents Fy 202020 20volume 20ii 20operating 20detail Pdf

West Virginia Purchasing Division