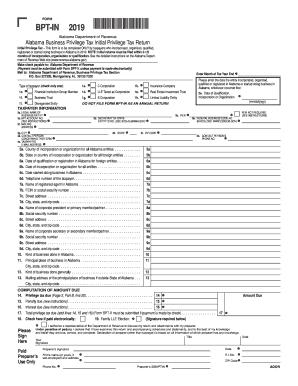

Alabama Business Privilege Tax Extension Form

13 rows If an extension has been granted for federal purposes the extension is also granted for. Form BPT-V Business Privilege Tax Payment Voucher Form BIT-V Business Income Tax Payment Voucher IMPORTANT.

Forms Alabama Department Of Revenue

In the upper right side of the table youll see a Search box.

Alabama business privilege tax extension form. The total cost and can range between 100 and 15000. The Business Privilege Tax Return shall be filed no later than the corresponding federal income tax. Alabama Corporate Income Tax Alabama grants an automatic extension of 6 months to file the Alabama Return but the full amount of the tax due for a tax year is due in full by the original due date of the return.

The Paid Tax Preparer Indicator field is required. There is no extension of time to file the form BPT-IN. The Privilege Tax Due field is required.

On the state website click Forms on the top menu. Read guidelines find documents and access forms in accordance with the Alabama Accountability Act. To generate a Form BPT-In page 1 and 2.

Select interview form AL16 - Alabama Business Privilege Tax Initial Privilege Tax computation Schedule. An extension of time for filing the Alabama Business Privilege tax Return and Annual Report will be given beginning and ending on. To make a business privilege tax payment use Alabama Form BPT-V.

Alabama Department of Revenue Business Privilege Tax Section PO. The Business Privilege Tax is calculated by multiplying the taxpayers net worth in Alabama assets minus liabilities by the corresponding tax rate. Input Initial Privilege Tax computation Schedule - boxes 30 - 63.

To make a corporate income tax payment use Alabama Form BIT-V. How does an entity elect to be treated as a family limited liability entity and therefore subject to the 500 cap provided for under the privilege tax statute. Box 327320 Montgomery AL 36132-7320.

Alabama Department of Revenue Business Privilege Tax Section PO Box 327320 Montgomery AL 36132-7320 Determination Period Used to Compute the Business Privilege Tax. Are credit unions subject to the Business Privilege Tax and or the Corporate Shares Tax levied in Chapter 14A Code of Alabama 1975. Form BPT-V is not required if payment is made electronically.

Enter the bold terms below and make sure to select the proper tax year which youll see in the far right column. Alabama Business Privilege Tax Returns must be filed by mail. There is no extension of time to file the form BPT-IN.

The form BPT-IN must be filed within two- and one-half months after the entity incorporates organizes qualifies or starts doing business in the State. Please contact the Alabama Department of Revenue if you have any questions regarding this extension. Business Privilege Tax Section PO Box 327431 Montgomery AL 36132-7431 If you are making a payment mail your return Form BPT-V and payment to.

Once youre at the Forms page youll need to type Alabama Business Privilege Tax Return in the search box. Form BPT-V must accompany all business privilege tax payments unless payments are made electronically. Alabama Department of Revenue electronic payments site.

Each type of business entity in the state of Alabama has a specific tax form to fill out each year. For automatic extension payments that are 750 or more the payment must be made electronically. Income Tax is responsible for the administration of individual income tax business privilege tax corporate income tax partnerships S-Corporation fiduciary and estate tax financial institution excise tax and withholding taxes.

Form BPT-IN Print Only Alabama Business Privilege Tax Initial Privilege Tax Return Form PPT. Fields marked with an are required. CPT This form combines the Annual Report and the Alabama Business Privilege Tax Return into one convenient form.

The forms are as follows. No paper or electronic extension form is needed to be filed to obtain the automatic extension. If your Alabama extension payment is less than 750 you may pay by check or money order.

The Payment Method field is required. To download and print your tax return youll need to visit the Alabama Department of Revenue website. The state of Alabama doesnt require any extension Form as it automatically grants extensions up to 6 months.

How is the Business Privilege Tax Calculated in Alabama. Visit the Alabama Department of Revenue. Information will flow to Form BPT-IN Alabama Business Privilege Tax Initial Privilege Tax Return.

Taxpayers making a payment of less than 750 for taxes due on a Form CPT PPT or BPT-IN return must complete and file Form BPT-V with the return. Alabama Department of Revenue Business Privilege Tax Payment Voucher DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT WHO MUST FILE. Form BPT-V must accompany all business privilege tax payments unless payments are made electronically.

The form BPT-IN must be filed within two- and one-half months after the entity incorporates organizes qualifies or starts doing business in the State. Download Business Privilege Tax Forms.

Other Alabama Taxpayer Forms Avenu Insights Analytics Taxpayer

Https Revenue Alabama Gov Wp Content Uploads 2021 01 21fpptinstr Pdf

Https Revenue Alabama Gov Wp Content Uploads 2018 01 18fcptinstr Pdf

Https Revenue Alabama Gov Wp Content Uploads 2019 12 20quickrefcptpptinst Pdf

Https Revenue Alabama Gov Wp Content Uploads 2021 01 21fbptvblk Pdf

Form Cpt Fillable Alabama Business Privilege Tax Return And Annual Report

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 Updated State And Local Tax Due Date Relief Developments Pdf

Form Cpt Fillable Alabama Business Privilege Tax Return And Annual Report

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 Updated State And Local Tax Due Date Relief Developments Pdf

Https Revenue Alabama Gov Wp Content Uploads 2018 01 18quickrefcptpptinst Pdf

Http Www Alabamaadministrativecode State Al Us Docs Rev 810 3 39 Pdf

Https Revenue Alabama Gov Wp Content Uploads 2019 12 20fcptblk Pdf

Https Revenue Alabama Gov Wp Content Uploads 2017 07 17quickrefcptpptinst Pdf

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 Updated State And Local Tax Due Date Relief Developments Pdf

Https My Cscglobal Com Reflib Dfforms Albptv Pdf

Https Revenue Alabama Gov Wp Content Uploads 2017 07 17fpptinstr Pdf

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 Updated State And Local Tax Due Date Relief Developments Pdf

Https Revenue Alabama Gov Wp Content Uploads 2021 01 21fpptblk Pdf

Alabama Business Privilege Tax Instructions 2019 Fill Out And Sign Printable Pdf Template Signnow

Alabama Business Privilege Tax Instructions 2019 Fill Out And Sign Printable Pdf Template Signnow