How Do I Get My 1099 Tax Form From Unemployment

After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. Once the 2020 1099G forms are uploaded PUA claimants can access their PUA-1099G via their PUA Dashboard.

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

1099-G forms are delivered by email or mail and.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

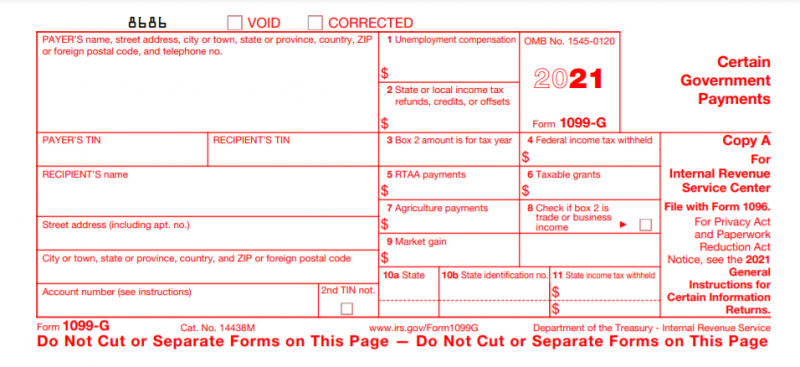

How do i get my 1099 tax form from unemployment. Thus your 1099G accurately reflects payments made to you. Instructions for the form can be found on the IRS website. Said another way offsets taken from your unemployment insurance payments have already been deducted from the amount of unemployment compensation we reported for you to the IRS and included on your Form 1099G.

After you are logged in you can also request or discontinue federal and state income tax withholding from each unemployment benefit payment. To access this form please follow these instructions. You may choose one of the two methods below to get your 1099-G tax form.

Email alerts will be sent to the claimants that elected to receive electronic notifications advising that they can view and print their 1099G online. 31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. Your 1099-G Form should be available in your CONNCET inbox no later than January 31.

You must update your mailing address by updating your personal information in the BEACON portal on the Maryland Unemployment Insurance for Claimants mobile app or by contacting a Claims Agent at 667-207-6520. For Pandemic Unemployment Assistance PUA claimants the. If you would like to request an additional copy of your 1099-G form to be mailed to your address on file please contact 800 244-5631.

If you havent received your 1099-G copy in the mail by Jan. I received a 1099-G Tax Notice from DWD but I did not file a claim for. Claimants may also request their 1099-G form via Tele-Serve.

Press 2 Individual. Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms. Call your local unemployment office to request a copy of your 1099-G by mail or fax.

When you do youll see an option to view my 1099-G. If you have questions about your user name and password see our frequently asked questions for accessing online benefit services. You can opt to receive your 1099-G electronically by providing your consent through the BEACON portal or mobile app.

How to Get Your 1099-G online. 31 of the year after you collected benefits. Once you subtract the federal and state income taxes from your 1099G amount it should match what you actually received.

Follow the prompts to schedule a callback. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. You will need this information when you file your tax return.

31 there is a chance your copy was lost in transit. The Department of Unemployment Assistance DUA will mail you a copy of your 1099-G by Jan. The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year.

Youll be issued a form 1099-G and youll see the amount of compensation youve received in box one. The Pandemic Unemployment Assistance PUA 1099G form will also be made available to download online. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

What is the IRS Form 1099-G for unemployment benefits. Press 2 Other questions about your 1099-G. The 1099-G tax form is commonly used to report unemployment compensation.

It will also be mailed to the mailing address the Department has. The 1099G forms for Regular Unemployment Compensation UC is now available to download online. The 1099G form reports the gross amount of unemployment compensation you have received not the net amount.

Your local office will be able to send a replacement copy in the mail. Unemployment compensation must still be reported on your federal tax return as its included with your other income such as wages salaries and bank interest. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form.

These forms will be mailed to the address that DES has on file for you. The example we have shows the person paid federal taxes on their benefits but not the state. Applicant Services 1099 Information The 1099s reflecting unemployment benefits paid in 2020 will be mailed to the last address on file no later than January 29 2021.

Then you will be able to file a complete and accurate tax return.

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Irs Forms 1099 Are Coming Key Facts For Your Taxes

Irs Forms 1099 Are Coming Key Facts For Your Taxes

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc