Should 1099 Employees Be Included In Ppp

How do partnerships apply for PPP loans and how is the maximum First Draw PPP Loan amount calculated for partnerships up to 10 million. You can have a Limited Liability.

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Although previous versions of this question stated yes as of April 10 2020 the answer is No.

Should 1099 employees be included in ppp. The only stipulation is that your business was operational as of February 15 2020. In fact according to PPP rules businesses are supposed to leave 1099 employees out of their payroll expenses entirely. The average number of full-time equivalent employees is determined by calculating the average number of full-time equivalent employees for each pay period falling within a month.

For more information on PPP loans generally go here. Compute 2019 payroll costs by adding the following. Can I use the PPP on back pay.

It is important to note that the independent contractor 1099 and or the sole proprietor can be eligible themselves for a PPP loan if it meets the application requirements. Employees IRS Form 943 should be provided in addition to or in place of IRS Form 941 as applicable. Essentially 1099 employees are supposed to apply for PPP loans on their own.

You should let your contractors and other 1099 workers know that they can and should apply directly with Womply for their own PPP loans. This page is about PPP loans for 1099 independent contractors. XYZ Enterprises also uses the contract services of Bob Smith and issues him a 1099 each year.

You work for a company as an employee and get a W2 tax form for employees and separately work via a 1099 or are otherwise Self-Employed. So it wouldnt make sense to include them twice Payroll reimbursements remember that the money includes has to be subject to payroll taxes. You may simply perform services as a non-employee.

What does that mean. The more recent Treasury Department guidance seems to suggest self-employed workers and independent contractors are treated the same and should not be counted because they can apply for a PPP loan on their own. Yes 1099 employees are eligible for the Paycheck Protection Program.

You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. Gig economy workers who take on-call jobs provided by companies such as Uber DoorDash Lyft TaskRabbit and Instacart. Earlier guidance from the SBA seemed to suggest employees who received a 1099 were included but independent contractors were not counted.

Regulations and guidance from the SBA and the US. Lets say a company called XYZ Enterprises Inc. Payments to anyone who is not on employee payroll whether theyre called independent contractors subcontractors or 1099 contractors are all ineligible payroll expenses.

If youre a sole proprietor 1099 and are interested in beginning your application process start here. That can be borrowed for partnerships partners self-employment income should be included on the partnerships PPP loan application individual partners may not apply for separate PPP loans. Department of Treasury on the PPP are evolving rapidly and the information contained herein be outdated.

Your boss can apply for PPP because he has employees you and you can separately get your own PPP based on your 1099self-employed earnings. Heres how the PPP loans would work in this situation. Yes back pay fits within the definition of payroll that is incurred and paid within the 24-week forgiveness period.

Independent contractors who collect 1099-MISC forms but for the PPP youll need to submit a Schedule C not your 1099s. The reason for this is that independent contractors are self-employed and thus can apply for their own PPP loans as of April 10 2020 to cover the pay they would have received and other expenses. The reason is that ICs are also eligible for this program.

The SBA includes the following QA on the topic. Should partners self- employment income be included on the business entity level PPP loan. XYZ Enterprises can apply for a PPP forgivable loan.

Independent contractors working on 1099s cannot be included in the Paycheck Protection Program under the CARES Act. Do independent contractors count as employees for purposes of PPP loan calculations. Has 10 employees and an owner who works at the company.

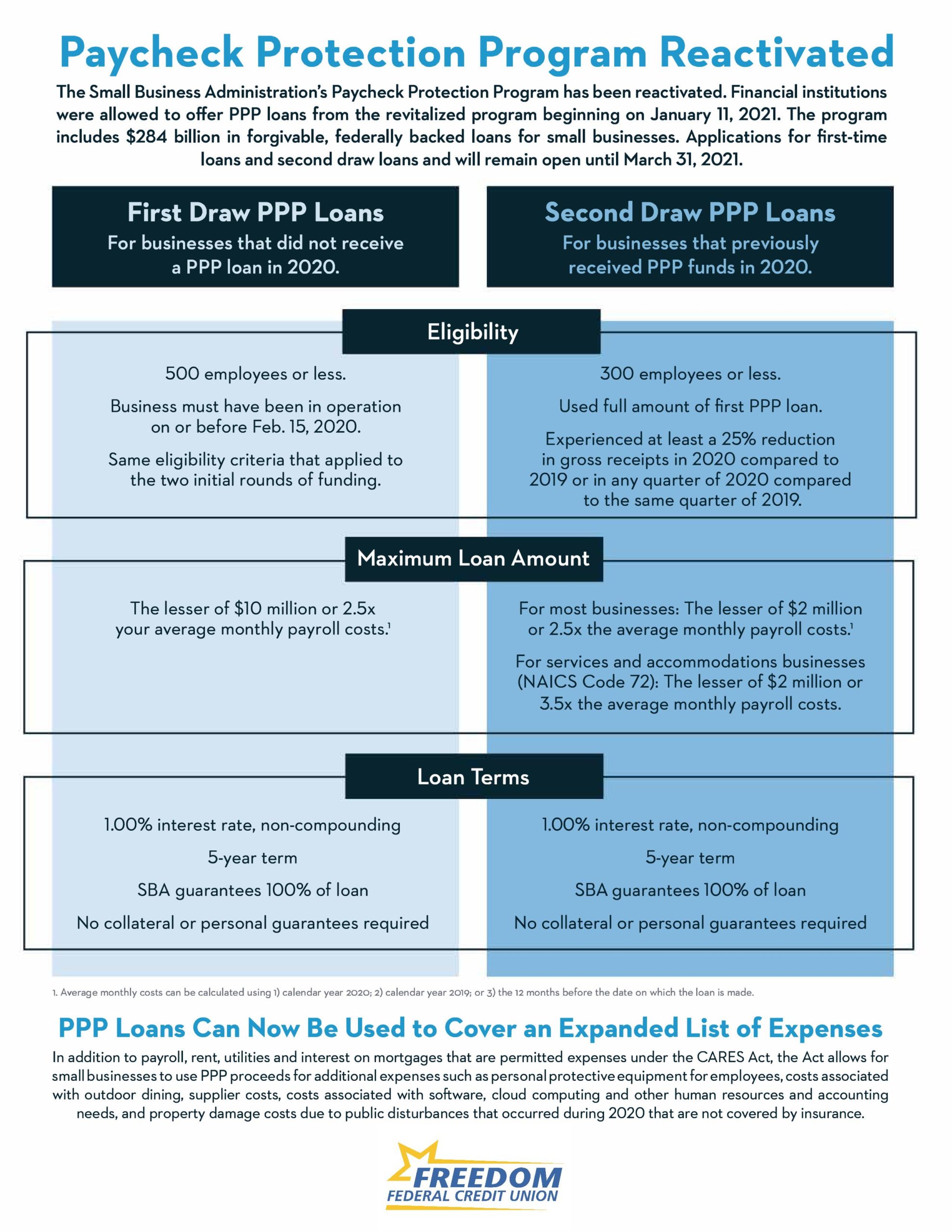

As of January 11 2021 PPP applications are open again. If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor. Paying workers with a 1099 is NOT having employees.

You started working on a 1099 late in 2019 or early 2020. Its free to apply and it could mean thousands of dollars in forgivable. If you are self-employed or a 1099 then you likely cannot use your PPP funds to pay yourself and continue to collect unemploymentbecause the payment you make to yourself counts as income which in most cases will disqualify you from continuing to receive unemployment.

If you only use 1099 workers you cant include that. Any amounts that an applicant has paid to an independent contractor or sole proprietor should be excluded from the eligible business payroll costs. If you did have employees you would issue W2s and pay employment taxes and Workers Compensation Insurance.

O 2019 Schedule K-1 IRS Form 1065 Net earnings from self-employment of.

1099 Nec Tax Services Accounting Firms Accounting Services

1099 Nec Tax Services Accounting Firms Accounting Services

How To Apply For The 1099 Ppp Loan

How To Apply For The 1099 Ppp Loan

How To Apply For The 1099 Ppp Loan

How To Apply For The 1099 Ppp Loan

Providers Can Now Get More Money From The Ppp Tom Copeland S Taking Care Of Business

Providers Can Now Get More Money From The Ppp Tom Copeland S Taking Care Of Business

Sba Ppp Guidelines For Sole Proprietors And Independent Contractors

Sba Ppp Guidelines For Sole Proprietors And Independent Contractors

How To Calculate Gross Income For The Ppp Bench Accounting

How To Calculate Gross Income For The Ppp Bench Accounting

Covid 19 Relief Payment Protection Program Freedom Federal Credit Union

Covid 19 Relief Payment Protection Program Freedom Federal Credit Union

Ppp Loan Faqs For Employers Stratus Hr

Ppp Loan Faqs For Employers Stratus Hr

How To Calculate Your Paycheck Protection Program Loan

How To Calculate Your Paycheck Protection Program Loan

Pin On Dndfinancialservices Org

Pin On Dndfinancialservices Org

How To Apply For Your Second Ppp Loan Bench Accounting

How To Apply For Your Second Ppp Loan Bench Accounting

Covid 19 Business Planning Williams Keepers Llc