How To Get My 1099 G Form Online

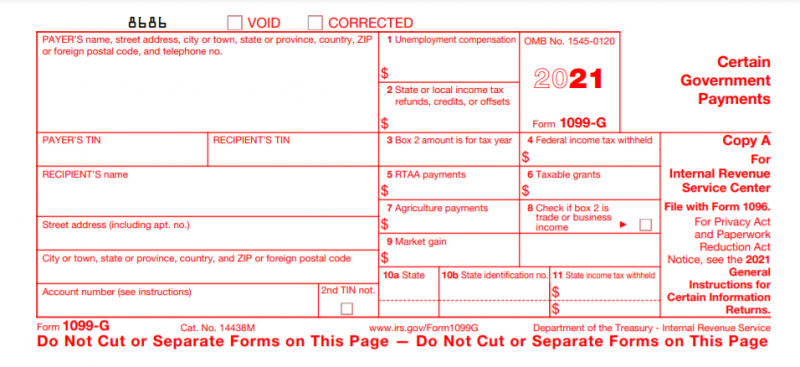

1099Gs are available to view and print online through our Individual Online Services. Form 1099-G information is used when preparing your federal tax return.

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

The New Mexico Department of Workforce Solutions mails all Unemployment Insurance 1099 tax information by the last day of January each year.

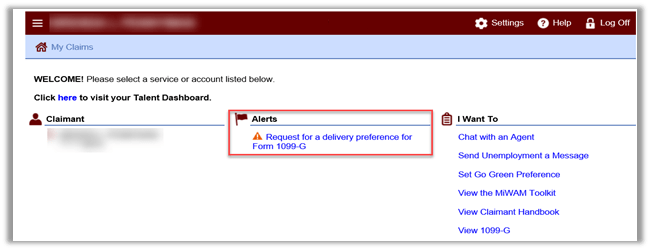

How to get my 1099 g form online. If you did not receive a 1099-G tax form because your address is not updated in your account you may request a new 1099-G and get your address changed at desazgov1099G-Report. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. To access a Form 1099-G electronically a taxpayer must first register for an e-signature account by establishing a User ID and Password.

We do not mail these forms. If you have a 1099 discrepancy call the NMDWS 1099G informational and message line at 505. Instead youll get a 1099G for the 2021 tax year.

These forms are available online from the NC DES or in the mail. I have been unable to get my correct 1099-G form from Florida EDD - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. If you did not receive your 1099G in the mail you can find it in the Online Claim System.

Sign up now to receive your 1099-G information online from our secure confidential web site. After you have successfully logged into. You can also download your 1099-G income statement from your unemployment benefits portal.

This will help save taxpayer dollars and allow you to do a small part in saving the environment. If an adjustment was made to your Form 1099G it will not be available online. Call 1-866-401-2849 Monday through Friday from 8 am.

To view and print your statement login below. To determine if you are required to report this information on a federal income tax return see the federal income tax instructions contact the IRS or contact your tax professional. 1 Online How to Access Your 1099-G Form Online Log in to your IDES account.

Ive heard that if I file myself online which I usually do and dont add my 1099 the IRS will basically fix it and send me a bill. Form 1099G tax information is available for up to five years through UI Online. Myunemploymentwisconsingov Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms.

After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. In the form insert your new address and click the box under the address line. You may owe Uncle Sam if you didnt withhold taxes.

You can elect to be removed from the next years mailing by signing up for email notification. 2 Mail IDES mailed paper copies of the 1099-G form in January to all claimants who opted NOT to receive their form. Form 1099-G for New Jersey Income Tax refunds is only accessible online.

You may choose one of the two methods below to get your 1099-G tax form. I have not received my 1099-G form and have been trying to get it through my state unemployment department and the IRS website but keep hitting walls. If you moved without updating your address with us your 1099G was sent to your old address.

Pacific time except on state holidays. Remember even if you were unemployed you still have to file income taxes. All of your benefit payments were made after Dec.

31 2020 you wont get a 1099G for the 2020 tax year. To view and print your current or previous year 1099-G tax forms online logon to the online benefits services website. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

Individuals can access copies of 1099 forms by logging into the UI Tax Claims System wwwjobsstatenmus Sunday through Friday from 400 am. Your 1099-G will be sent to your mailing address on record the last week of January. Department of Unemployment Assistance.

Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. Taxpayers and practitioners can access an electronic version of Forms 1099-G via the Personal Income Tax e-Services Center. Look for the 1099-G form youll be getting online or in the mail.

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Printable 1099 G Form Get 2020 Blank And Fill It

Printable 1099 G Form Get 2020 Blank And Fill It

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

1099 G Form Copy B Recipient Discount Tax Forms

1099 G Form Copy B Recipient Discount Tax Forms

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

1099 G Fill Online Printable Fillable Blank Pdffiller

1099 G Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Florida Residents Report Problems Accessing 1099 G Form Youtube

Florida Residents Report Problems Accessing 1099 G Form Youtube

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

1099 G 2018 Public Documents 1099 Pro Wiki

Va Refund 1099g Taxes Zip Code Schedule Northern Virginia Virginia City Data Forum

Va Refund 1099g Taxes Zip Code Schedule Northern Virginia Virginia City Data Forum

1099g Maryland Fill Online Printable Fillable Blank Pdffiller

1099g Maryland Fill Online Printable Fillable Blank Pdffiller

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller