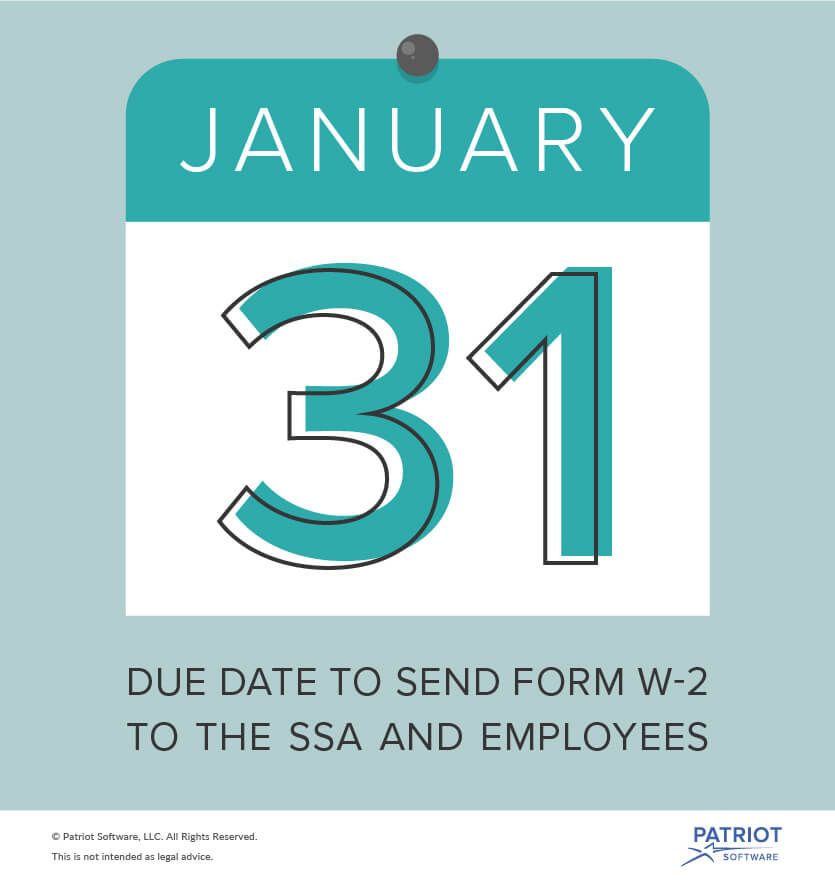

W2 Form Employer Deadline

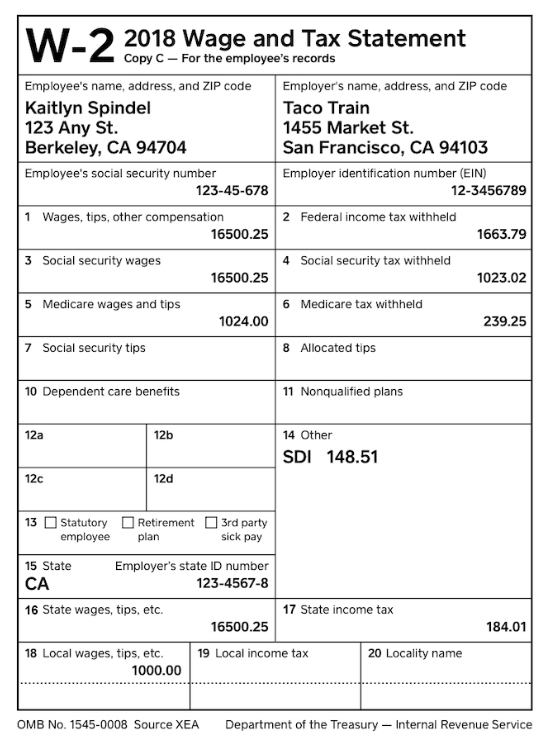

That is the absolute last day to send out W-2s. If employers do not give employees an accurate W-2 form by the deadline or if they submit late forms to the SSA they can receive a 30.

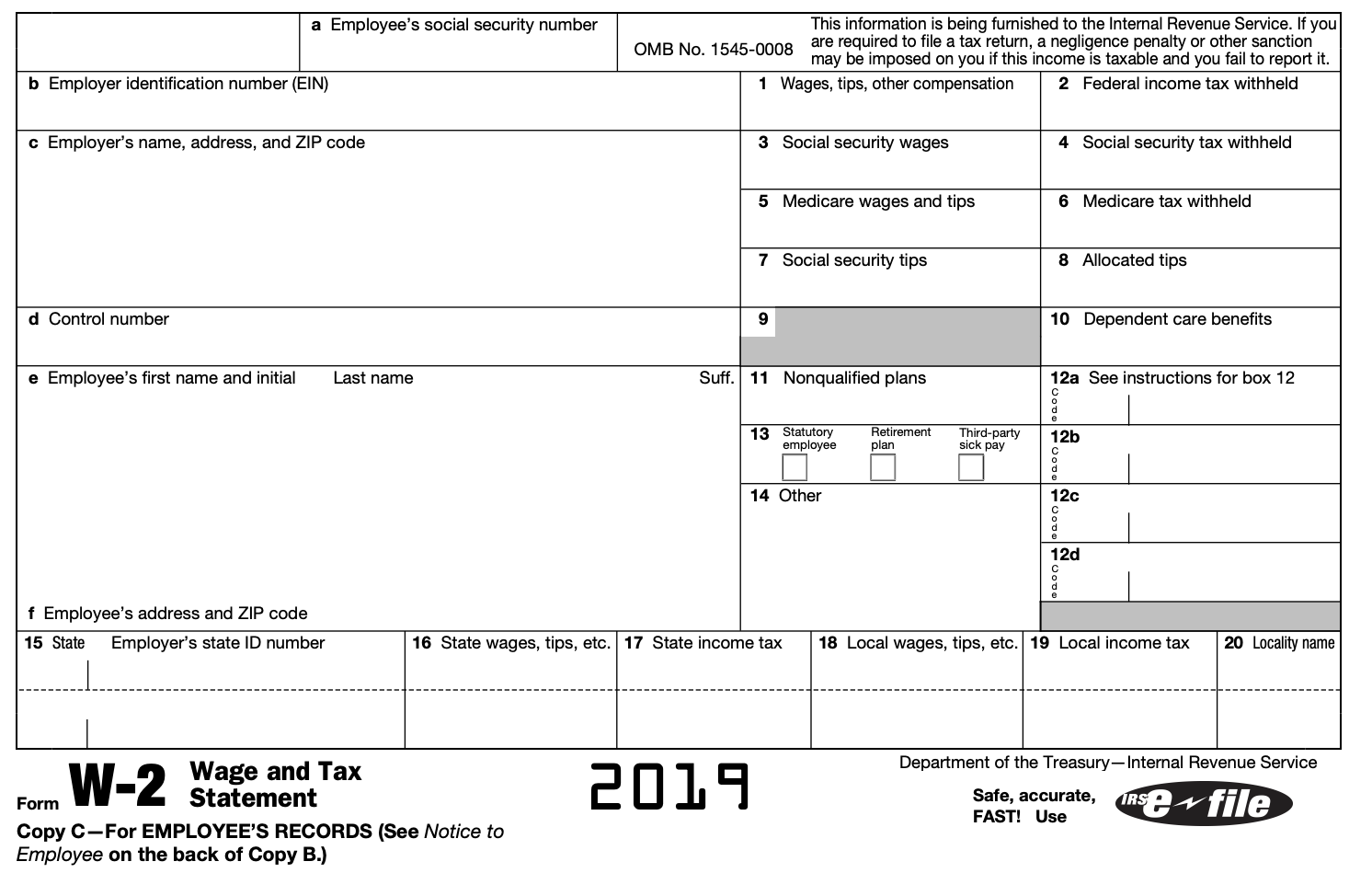

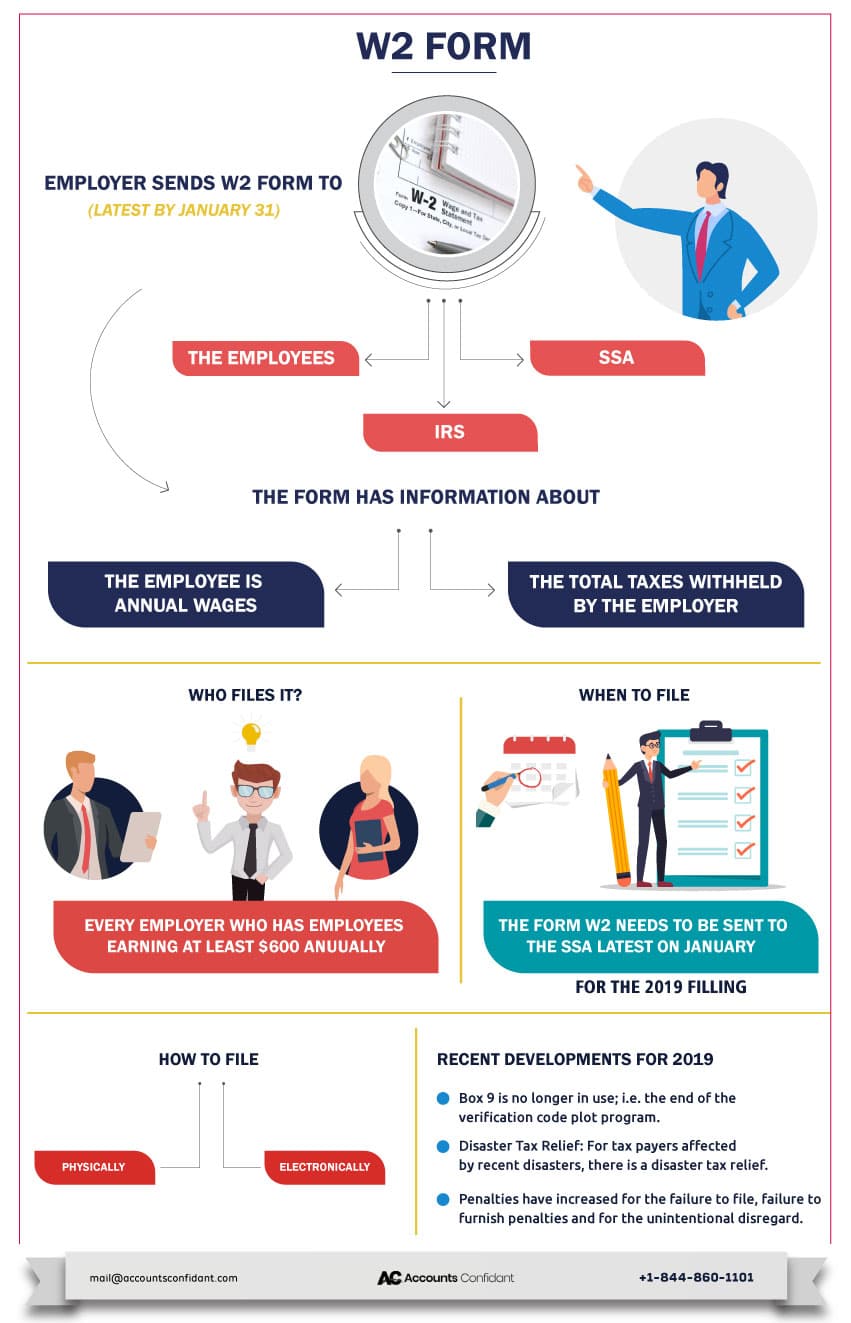

What Is A W2 Form Instructions Deadlines W2 Form 2019

What Is A W2 Form Instructions Deadlines W2 Form 2019

Send Copies B C and 2 of Form W-2 to each employee by January 31.

W2 form employer deadline. W-2s can also be electronically distributed. Please visit our Whats New for Tax Year 2020 page for important wage reporting updates. Employers have until January 31 to mail out W-2s which means your W-2 should arrive any day now.

This allows you plenty of time to prepare your tax return by the filing deadline which is usually April 15. If you dont receive your W-2 by the W-2 Form Deadline ask your employer for it. IR-2020-269 December 3 2020.

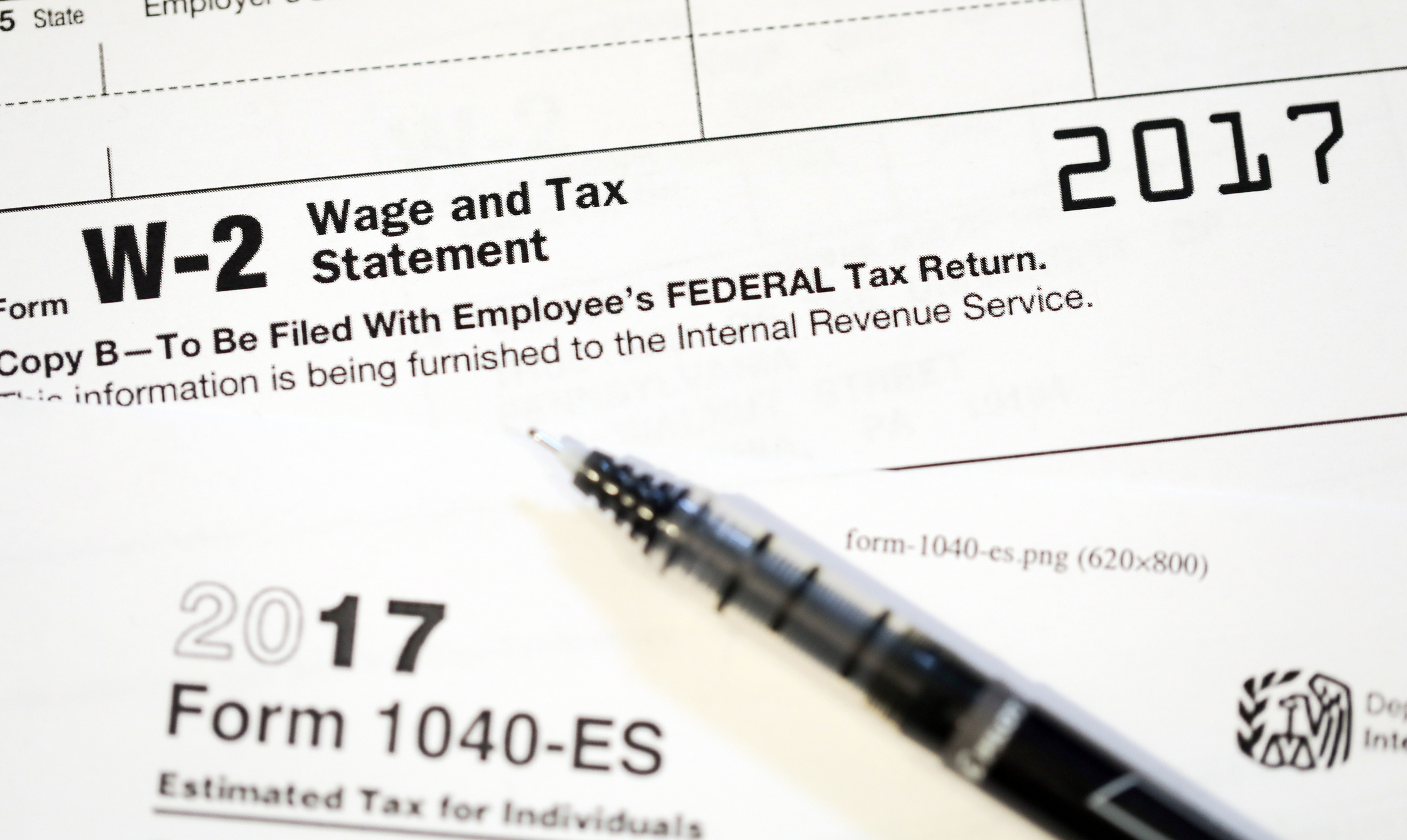

Wage reports for Tax Year 2020 are now being accepted. Regarding the W-2 Form Deadline your employer should issue W-2 Forms to you no later than Jan. Paper forms must generally be sent to the SSA by Feb.

IRS to employers. Most employers will hand out or mail your W-2 form by January 31st at the latest. The January 31 deadline also applies to certain Forms 1099-MISC Miscellaneous Income filed with the IRS to report non-employee compensation to independent contractors.

If this date falls on a Saturday Sunday or legal holiday the deadline will be the next business day. 31 each year so that the employee has ample time to file income taxes before the deadline which is April 15 in most years. Employment Tax Publications You May Find Useful.

Attention Tax Year 2020 Wage Filers. The employer must send the employee the W-2 form on or before Jan. 31 filing deadline remains for employer wage statements independent contractor forms.

February 1 is the deadline for employers to issue and file wage statements. Employers must file their copies of Form W-2 Wage and Tax Statement and Form W-3 Transmittal of Wage and Tax Statements with the Social Security Administration by January 31. You can also check our database to find your W-2 onlineand have it.

If Forms W-2 are filed after the deadline the employer will incur late-filing penalties which is. Online Ordering for Information Returns and Employer. What if its February but I still dont have my W-2 Say Thanks by clicking the thumb icon in a post.

Employers must file Form W-2 and other wage statements by Monday February 1 2021. You can also distribute Form W-2 electronically. Your employer is supposed to get your W-2 to you no later than January 31.

This means you may not receive it until the first or second week of February. Employees dont technically have to have W-2s in hand but at a minimum the envelope must bear an official January 31st or earlier postmark. Reminder Tax Year 2020 wage reports must be filed with the Social Security Administration by February 1 2021.

If you are waiting on a corrected W-2 from your employer the link provided below provides some things you can do while waiting. WASHINGTON The Internal Revenue Service today reminded employers that they must file Form W-2 and other wage statements by February 1 2021 to avoid penalties and help the IRS prevent fraud. What happens if employer doesnt send w2 by Jan 31.

The deadline date by which you need to have distributed W-2s to employees is January 31st. Your employees dont have to physically have the forms by that date but the deadline to mail W-2 forms is January 31. January 31st is the deadline to distribute Forms W-2 to employee s.

WASHINGTON The Internal Revenue Service today reminded employers and other businesses that wage statements and independent contractor forms still have a January 31 filing deadline. 4 rows Its important for the employers to send W-2s to their employees and file them to SSA before the. All Form W-2 C Revisions.

Luckily the IRS sets the deadline for when employers need to file the W-2. If you dont receive your W-2 by the W-2 Form Deadline ask your employer for it. Before the Protecting Americans from Tax Hikes PATH Act employers generally had a longer period of time to.

All employers regardless of how many employees working for them are required to file Form W-2 by January 31st. What Is The Form W-2 Deadline. Remember February 1 2021 deadline for Form W-2 other wage statements.

Employer W-2 Filing Instructions Information. Regarding the W-2 Form Deadline your employer should issue W-2 Forms to you no later than Jan. If the 31st of January falls on a weekend your employer will have a few more days to send it out before the W-2 deadline.

January 31st is the deadline to file W-2s using Business Services Online or to submit paper Form W-2.

The Best Ways To Gain Access To Your W 2 Form By Cletuskurt1109 Issuu

The Best Ways To Gain Access To Your W 2 Form By Cletuskurt1109 Issuu

W 2 Deadline Penalties Extension For 2020 2021 Checkmark Blog

W 2 Deadline Penalties Extension For 2020 2021 Checkmark Blog

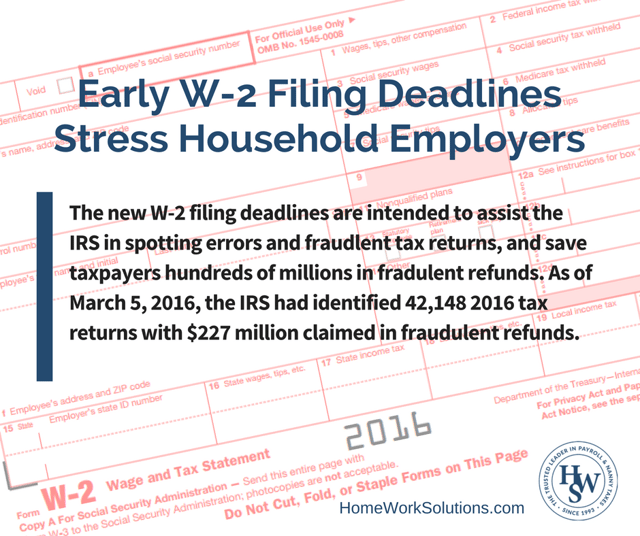

Early W 2 Deadlines Stress Household Employers

Early W 2 Deadlines Stress Household Employers

Two Websites To Get Your W2 Form Online For 2020 2021

Two Websites To Get Your W2 Form Online For 2020 2021

W 2 1099 Tax Reporting Deadline Approaches Rocket Lawyer

W 2 1099 Tax Reporting Deadline Approaches Rocket Lawyer

It S W 2 Season The Deadline Is January 31 Marathonhr Llc

It S W 2 Season The Deadline Is January 31 Marathonhr Llc

What Employers Need To Know About W 2 And 1099 Filing Deadlines Resourcing Edge

What Employers Need To Know About W 2 And 1099 Filing Deadlines Resourcing Edge

W 2 Deadline When Do W 2s Have To Be Sent Out

W 2 Deadline When Do W 2s Have To Be Sent Out

W 2 Vs W 4 What S The Difference Seek Business Capital

W 2 Vs W 4 What S The Difference Seek Business Capital

Irs To Employers Remember February 1 2021 Deadline For Form W 2 Other Wage Statements Youtube

Irs To Employers Remember February 1 2021 Deadline For Form W 2 Other Wage Statements Youtube

What Is A W2 Form Instructions Deadlines W2 Form 2019

What Is A W2 Form Instructions Deadlines W2 Form 2019

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Reminder Submit W 2 Changes Southland Data Processing

Reminder Submit W 2 Changes Southland Data Processing

2021 Deadline For W 2s Closer Than You Think Taxing Subjects

2021 Deadline For W 2s Closer Than You Think Taxing Subjects

W 2 Form Filing Deadline And Faqs Square

W 2 Form Filing Deadline And Faqs Square

W2 1099 Deadline Is January 31 Lupe Ruiz