How To Add A 1099 Employee

Heres a brief rundown of how to fill out Schedule C. By hiring a 1099 employee your company has the flexibility to bring on specific people for specific projects.

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

Open from the Accounting tab and go to your Chart of Accounts.

How to add a 1099 employee. Name the account Independent Contractor Labor or something that makes sense to you and is easy to remember. Both the IRS and many states have detailed rules that classify workers as an employee who receives a W-2 or an independent contractor who receives a 1099 tax form. One difference is that standard employees have yearly income reported on a W-2 while 1099 employees have income reported on a 1099.

PPP applications opened for 1099 employees on April 10 2020. The W-2 also shows how much federal income tax as well as state and local taxes were withheld. Select Expenses as the Account Type and Cost of Labor.

Unlike for salaried jobs with your filing status taxes arent automatically withheld from your self-employment income pay stubs throughout the year. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. This will often give you the option to hire top-notch talent without the obligation to retain them long-term.

Independent contractors or 1099 employees have to do without a steady paycheck health insurance or retirement programs with corporate matching from employers. Create a new account like the one pictured below. These types of workers pay the IRS utilizing the form you sent them if you feel uncertain as to who to give 1099s to just remember these non employees are workers that provided labor or services to you for which you have paid more than 600 in the corse of the year for these non- employees youll need to send them a 1099 and you have till.

Form 1099 doesnt show withheld taxes because the contractor is responsible for paying those. When you have an additional 1099 to file after filing the 1096 form the process to add a 1099 is fairly simple and just requires a little extra paperwork. This allows them to set their own rates and hours as well as puts taxes benefits and tools responsibilities on the 1099 employee rather than the employer.

Yes qualifying independent contractors can receive an additional disbursement of funds by applying for a Second Draw. However the benefits to employers are often extensive and worth taking notice of. Theres less initial paperwork to.

1099 employees are now eligible to apply for their own PPP loans through their banks or a loan marketplace. How to file Schedule C for 1099-MISC. If youre using a 1099 employee you will first want to create a written contract.

However that is not the only distinction. Benefits of Using a 1099 Employee. Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return.

If you would like to switch the team members employment type click the applicable box on the Team Members payroll profile in the Payroll Team tab in your online Payroll dashboard or Square Payroll. 1099 employees can obtain a number of important benefits from this working relationship including the ability to work on a more flexible basis change work environments on a routine basis run their own business and have greater freedom. Since people who are self-employed are on their own saving for retirement is even more crucial than for W-2 or full-time employees.

Whether youre a freelancer 1099 contractor small business owner or any other type of self-employed worker your independent contractor taxes are going to be a bit more complicated and maybe even scary than you might expect. For 2019 the wage base increases to 132900 so an employee with wages up to or above the maximum in 2019 would pay 823980 in tax and the employer would pay an equal amount. If your employee wages exceeded the annual Social Security tax limit you wouldnt have to pay any Social Security tax on your 1099 income.

Complete Your 1099 Once you discover your error and realize you have an additional 1099 to file after filing the 1096 form simply fill out the 1099 form you missed the first time around. Employing an independent contractor allows for simpler administration. If you need help with employee classification or filing the appropriate paperwork post your need in UpCounsels marketplace.

A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made. A 1099 employee is also known as an independent contractor The 1099 employee is essentially self-employed through individual contracts with an employers. If you pay them 600 or more over the course of a year you will need to file a 1099-MISC with the IRS and send a copy to your contractor.

Square Payroll allows your team members to be classified as both a W-2 employee and a 1099 contractor. In a nutshell employee compensation is tallied on a Form W-2 and contractor compensation is calculated on a Form 1099. If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor.

Can 1099 Workers Receive a Second Draw. If you sold physical products subtract your returns and cost of good sold to get your gross income. Calculate your gross income by adding up all the income from your 1099 forms and any employer who paid you less than 600.

Hiring A 1099 Contractor The Employer S Paperwork Checklist Gusto

Hiring A 1099 Contractor The Employer S Paperwork Checklist Gusto

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

5 Things To Know Before Hiring A 1099 Employee

5 Things To Know Before Hiring A 1099 Employee

How To Manage 1099 Sales Reps Independent Contractors

How To Manage 1099 Sales Reps Independent Contractors

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

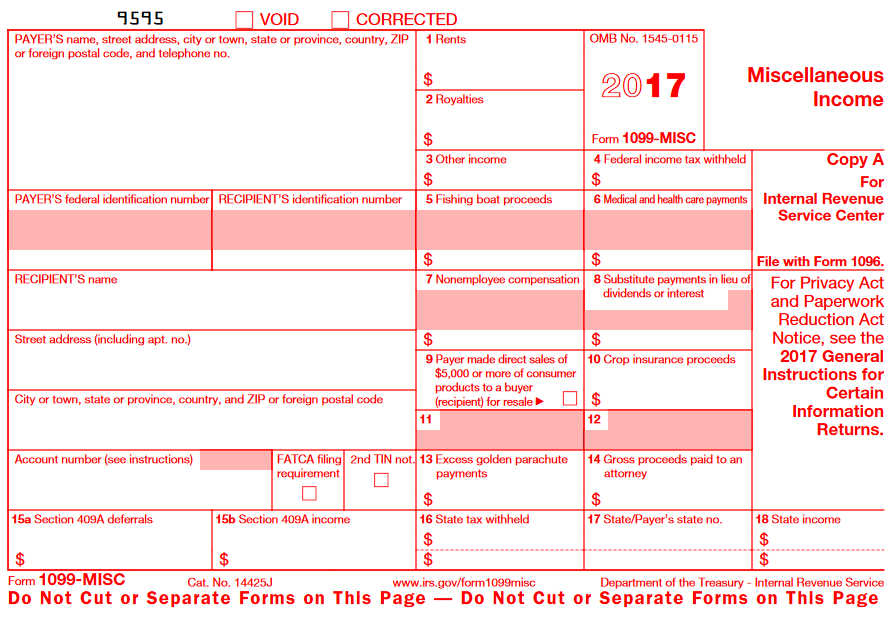

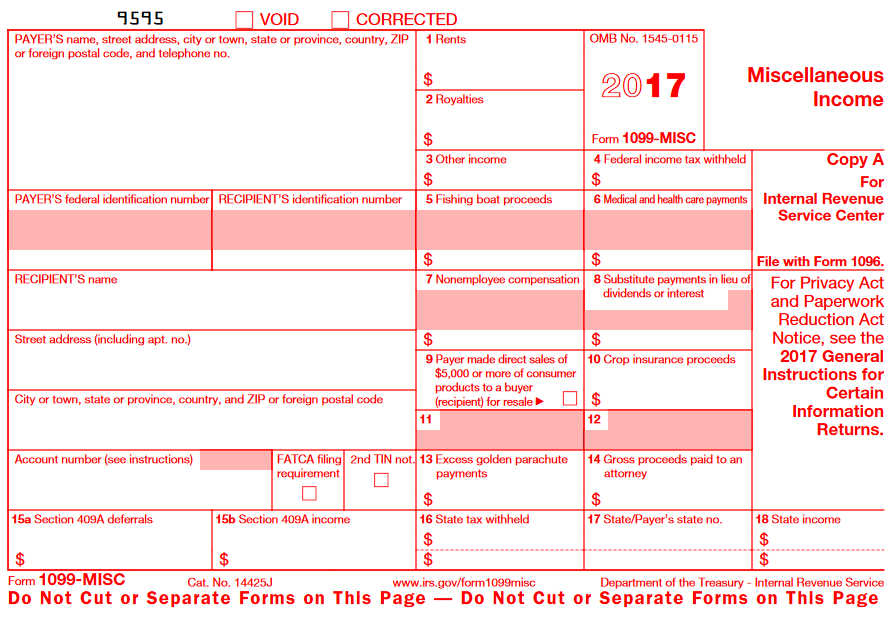

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

By 2020 50 Of Americans Are Expected To Be Independent Contractors Freelancers Alexander S Blog

By 2020 50 Of Americans Are Expected To Be Independent Contractors Freelancers Alexander S Blog

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax