How Do I Get My Military 1099 R

Use Code 7 in box 7 for reporting military. We make the last 5 years available to you online.

To access your 1099-R information online.

How do i get my military 1099 r. If you need a statement of benefits paid please contact your VA Regional Office. Therefore VA does not send out 1099 forms. Youll generally receive one for distributions of 10 or more.

You can request your 1099R be sent either to your current address or to a new address using an online form. If you are having a hard time finding your military or retirement W-2 or 1099R dont worry they are always available online on the Defense Finance and. Please note that 1099-R reissues requested through AskDFAS cannot be mailed prior to February 10 2021.

Sign in to your online account. A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts. Start direct deposit of your payment or change the account or financial institution to which your payment is sent.

The federal tax filing deadline for individuals has been extended to. MyPay does a good job of keeping an online repository of these forms but technical issues have been known to happen. All 1099-R Forms will mail by January 31.

You can request your 1099R sent to your address of record or to a one-time seasonal address. You should receive a copy of Form 1099-R or some variation if you received a distribution of 10 or more from your retirement plan. Retirees seeking their 1099R have two options.

Click My Account Login in the upper right corner. About Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. However starting January 15 you can log in to your ERS OnLine account to view and print your 1099-R information.

How to access your 1099-R tax form. You will receive your 1099R in the mail in seven to ten business days. You can also call our toll-free number 1 888 767-6738 for these and many of your voluntary withholdings.

Report payments to military retirees or payments of survivor benefit annuities on Form 1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient not that of the military retiree. Click 1099-R Tax Form in the menu to view your most recent tax form.

How do I obtain a 1099 form from VA. File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from. VA benefits are not taxable.

How do I enter military retirement 1099-r. Click on Federal Taxes Personal using Home and Business Click on Wages and Income Personal Income using Home and Business Click on Ill choose what I work on if shown Scroll down to Retirement Plans and Social Security On IRA 401 k Pension Plan. Even though myPay stores a long-term copy of your military pay and tax forms its always a good idea to keep permanent copies of your W-2s 1099s 1095s LES or RAS statements and related forms.

Corrected Forms 1099-R will be issued late Februaryearly March. If you have not received Form 1099-R by mid-February you can print a copy from My Account. Send us a written request by fax or mail but make sure you leave us time to reply.

Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. One for the IRS. Your 1099R will be in the mail to you within 7 to 10 business days.

If you are expecting a corrected Form 1099-R you may wish to wait to file your taxes until you receive the form. Retrieve it from their MyPay account or call the DFAS Retiree and Annuitants customer service telephone line at 1. When using self-service systems you need your claim number.

Establish change or stop a checking or savings allotment. You can also update your mailing address permanently using a separate online form. Be prepared to provide your Social Security number date of retirement if you are a recent retiree and your current mailing address.

Profit-sharing or retirement plans. View a statement describing your annuity payment. Go to OPM Retirement Services Online.

The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they issue. Do you prefer traditional mail. Select a year from the dropdown menu to view tax forms from other years.

Plus you can request prior year 1099Rs.

Turbotax Free Military Taxes 2020 2021 Online Tax Filing For Active Duty Military And Reserves

Turbotax Free Military Taxes 2020 2021 Online Tax Filing For Active Duty Military And Reserves

Reporting Tricare On Your Tax Return Military Com

Reporting Tricare On Your Tax Return Military Com

Maximize Your Tax Refund Tax Refund How To Get Smarter Think Big

Maximize Your Tax Refund Tax Refund How To Get Smarter Think Big

How To Report Backdoor Roth In Turbotax Turbotax Roth Disability Payments

How To Report Backdoor Roth In Turbotax Turbotax Roth Disability Payments

Https Home Army Mil Carlisle Index Php Download File View 328 498

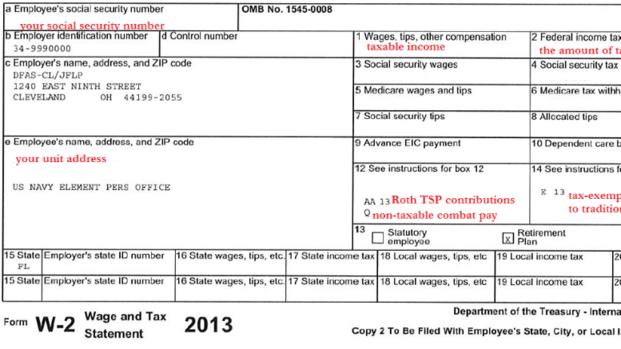

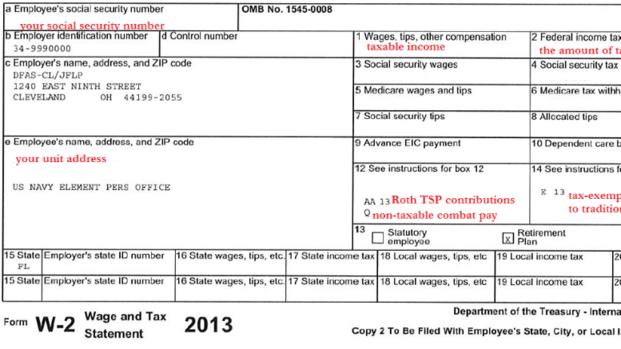

Get A Replacement W 2 Or 1099r Military Com

Get A Replacement W 2 Or 1099r Military Com

Tax Statements For Separated Troops Military Com

Tax Statements For Separated Troops Military Com

Taxable Income From Retired Pay Military Com

Taxable Income From Retired Pay Military Com

Income Taxes And The Military Department Of Taxation

Income Taxes And The Military Department Of Taxation

Turbotax Offers Free Tax Filing For Military Active Duty And Reserve The Turbotax Blog

Turbotax Offers Free Tax Filing For Military Active Duty And Reserve The Turbotax Blog

Transition Leave Overview Military Com

Transition Leave Overview Military Com

Income Taxes And The Military Department Of Taxation

Income Taxes And The Military Department Of Taxation

First Crusade Siege Of Jerusalem 1099 Ad Youtube Jerusalem Crusades Military History

First Crusade Siege Of Jerusalem 1099 Ad Youtube Jerusalem Crusades Military History

Va Disability Compensation Affects Military Retirement Pay

Va Disability Compensation Affects Military Retirement Pay

3 Reasons Not To File Your Tax Return Yet Military Com

3 Reasons Not To File Your Tax Return Yet Military Com

2021 Retired Military Pay Dates Annuitant Pay Schedule

2021 Retired Military Pay Dates Annuitant Pay Schedule

Whiteman Air Force Base Community Tax Toolkit

Whiteman Air Force Base Community Tax Toolkit