How To Register For Flat Rate Vat Online

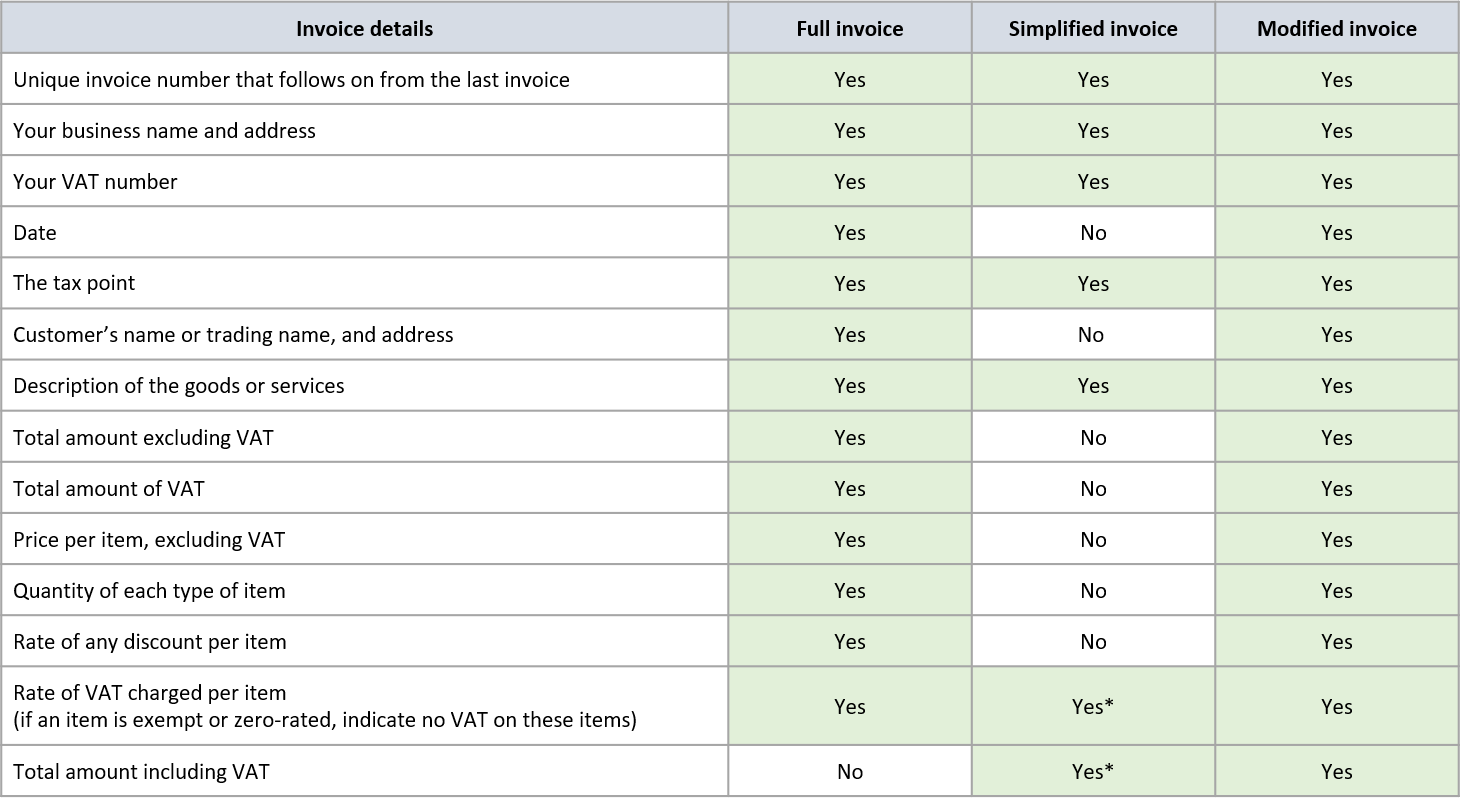

Details of the total amount you have invoiced during the VAT period covered in your return. The VAT rate also differs depending on your chosen VAT scheme.

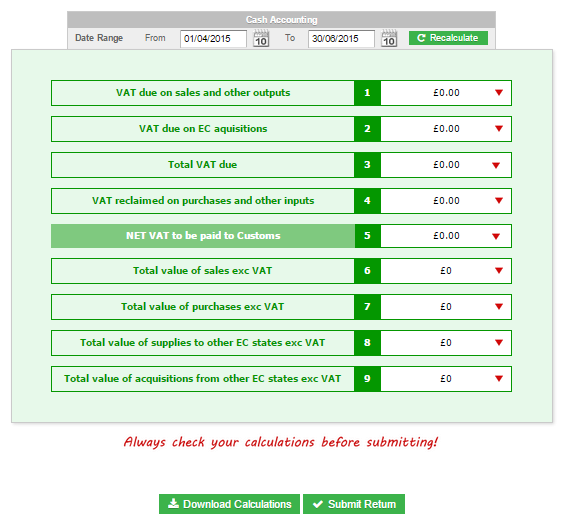

Vat Returns Guide Vat Quickfile

Vat Returns Guide Vat Quickfile

From the Needs Attention list click Review by the earliest return period.

How to register for flat rate vat online. VAT inclusive turnover x VAT flat rate amount due. How to register for the VAT Flat Rate Scheme. You can join the scheme online when you register for VAT or by post by completing form VAT600FRS located on the GOVUK website.

The easiest way to file your paperwork is to submit VAT return online. The VAT due to be paid to HMRC would be 600 x 85 4250. Login pages can be found here.

Under Tax click VAT Return. You can also fill in VAT600 FRS and either. If you do choose to become VAT registered you can register online.

As of 2019 companies with a turnover of more than 85000 are required to digitally store their records and use software to submit their VAT. Advantages and disadvantages of the VAT Flat Rate Scheme. Youll get those when you register as self-employed.

Who can join the FRS. Heres a quick guide to help you decide whether registering for the Flat Rate VAT scheme is right for your businessRemember to consider who your client is. I attempted to apply for flat rate for a client in similar circumstances and HMRC refused on the basis that the flat rate scheme is only available to those who are registered for VAT at the time the flat rate application is considered by HMRC.

Your VAT flat rate percentage. Do not use the. Youre a VAT registered business you expect your VAT taxable turnover to be 150000 or less excluding VAT in the next 12 months.

Send it by post. In the Accounting menu select Reports. Step 1 Value Your Stock at Cost.

A trader wishing to join the flat rate scheme must have VAT-exclusive turnover of 150000 or less. When you use the Flat Rate Scheme FRS you pay VAT as a fixed percentage of your VAT inclusive turnover. The Flat Rate Scheme can still be an excellent choice if you have very little VAT-able expenses to claim.

You can register for VAT online although its also possible to use a VAT1 paper form to register if you need to. You may find that although you pay a little more VAT. Your HMRC Online Account login and password so you can fill in your flat rate VAT return online.

So for example if your work is in the printing category and a customer pays 500 plus 20 VAT totalling 600. VAT to be paid to HMRC for the quarter is 1980. You can join the scheme online when you register for VAT.

You can join the Flat Rate Scheme if. The levies are to be charged at every stage that a VAT Standard rated supply is made by VAT Registered Taxpayer. Step 2 Deduct the Cost of Stock Which You Wont Be Able to Recover Input VAT on.

To fill in the form youll need to following information. Filling Out the Flat Rate VAT Return. Claiming for VAT on Stock When Leaving the Flat Rate Scheme.

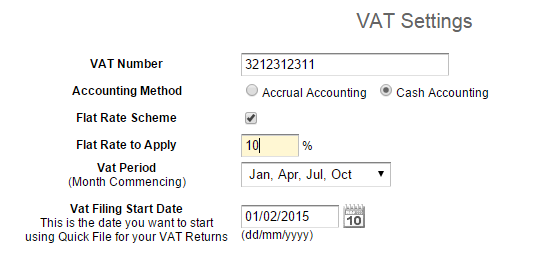

How to register for VAT. If your business is entitled select the Flat Rate Scheme FRS checkbox. Firstly you need to value your stock at the VAT exclusive amount.

Your VAT codes are now set up. If you are eligible for and choose the VAT flat-rate scheme the VAT flat rate will vary based on your type of business. One thing worth noting is it can take around a month or even longer to process a VAT application.

Enter your VAT registration number. Copies of any purchase invoices over 2000 that you need to reclaim VAT on. However with the flat rate scheme you pay a fixed rate of VAT to HMRC and keep the difference between that and the amount of VAT you charge your customers.

Before you log in youll need to make sure you have a VAT number and a Government Gateway account. If the Update financial settings box shows enter your Flat rate percentage then click Update. This may involve you doing a stock take at the.

It is possible to apply by post phone or email but the easiest way is probably to fill in the online application form VAT600FRS. VAT Registered Taxpayers cannot claim the NHIL the GETFund charged on their purchases ie. Goods charged at the VAT Flat Rate of 3 are not subject to the NHIL GETFund.

Your business needs to be registered for VAT in order to join the VAT Flat Rate Scheme. Use form VAT600FRS to apply to join the Flat Rate VAT Scheme. This is a straightforward process though and is done on the HMRC website when registering online.

The actual percentage you use depends on your type of business. Before you start If youre using an older browser for example Internet Explorer 8 youll need to update it or use a different. An application to join the scheme can be made online here or by post on Form VAT600 FRS.

Email it to frsapplicationsvrshmrcgsigovuk. When you use standard VAT accounting the VAT you pay to HMRC or claim back from them is the difference between the VAT you charge your customers and the VAT you pay on purchases. The business has effectively kept the remaining 20 of VAT.

The levies are not subject to input tax deduction. You would use this simple sum to work out how to calculate VAT on the Flat Rate Scheme.

Company Service Free Registration In Bulgaria How To Open A Company For 3 Three Days Accounting Services Company Bank Fees

Company Service Free Registration In Bulgaria How To Open A Company For 3 Three Days Accounting Services Company Bank Fees

What Is The Tampon Tax Why Do You Need To Pay It Tampon Tax Tampons Accounting

What Is The Tampon Tax Why Do You Need To Pay It Tampon Tax Tampons Accounting

What Is Tin Tax Identification Number In Uae Audit Services Tax Informative

What Is Tin Tax Identification Number In Uae Audit Services Tax Informative

An Introduction To The Standard Vat Method Inniaccounts

An Introduction To The Standard Vat Method Inniaccounts

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

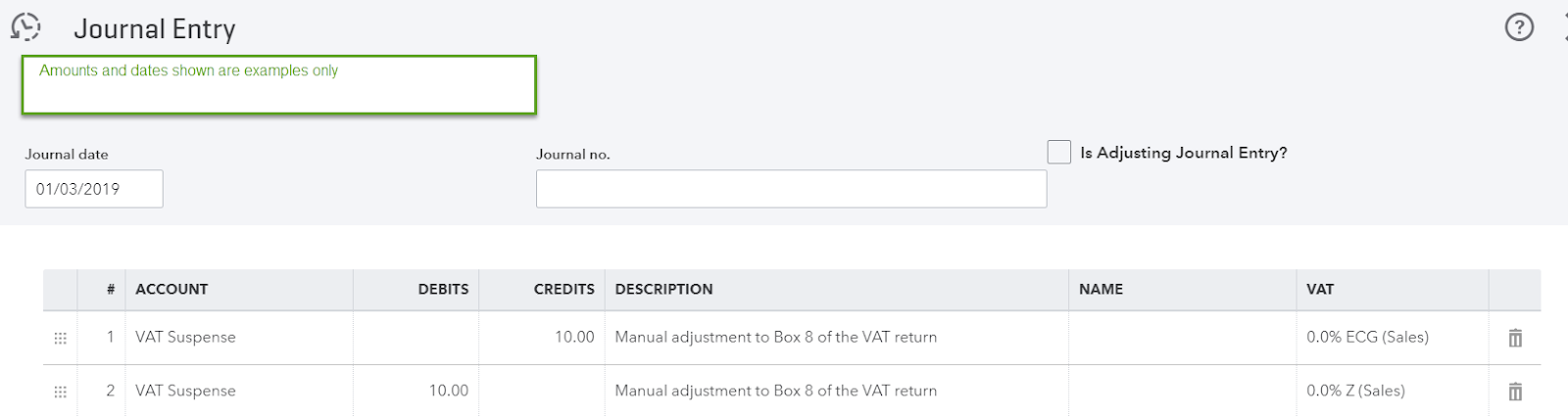

Make Vat Adjustments In Quickbooks Online

Make Vat Adjustments In Quickbooks Online

Advance Flat Rate Shipping Method For Woocommerce Woocommerce Create Ads Flat Rate Shipping

Advance Flat Rate Shipping Method For Woocommerce Woocommerce Create Ads Flat Rate Shipping

Understanding Buyer Persona How To Attract Target Customers Buyer Personas How To Attract Customers Target Customer

Understanding Buyer Persona How To Attract Target Customers Buyer Personas How To Attract Customers Target Customer

Ap Commercial Tax Tax Commercial Accounting

Ap Commercial Tax Tax Commercial Accounting

Vat Flat Rate Scheme Avec Images Meilleur Taux Formation Marketing Achat Voiture

Vat Flat Rate Scheme Avec Images Meilleur Taux Formation Marketing Achat Voiture

Online Accountant Reading Accounting Online Growing Your Business

Online Accountant Reading Accounting Online Growing Your Business

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

Claim Child Benefits Online Information Uk Rules Rules Benefit Children

Claim Child Benefits Online Information Uk Rules Rules Benefit Children

Vat Returns Guide Vat Quickfile

Vat Returns Guide Vat Quickfile

An Introduction To The Standard Vat Method Inniaccounts

An Introduction To The Standard Vat Method Inniaccounts

Sell Your Products On Multiple Online Sites Through Buymarg Without Registration Vat Cst Sell Your Products On Amazon Selling Online Online Online Sites

Sell Your Products On Multiple Online Sites Through Buymarg Without Registration Vat Cst Sell Your Products On Amazon Selling Online Online Online Sites