How To File 1099 Nec Electronically Free

If you file Form 1099-NEC within 30 days after the deadline there will be a penalty of 50return. Free support for self-employed income independent contractor freelance and other small business income.

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

If you are submitting less than 250 forms you are not required to file electronically but you can through SWIFT Secure Web Internet File Transfer.

How to file 1099 nec electronically free. E-File of 1099-NEC can only be accomplished via TTax by clicking Choose Online Thus online only RE. Filer must use IRS 1099-NEC form 2020 for reporting non-employee payments with the IRS and recipient. Try it for FREE and pay only when you file.

On or before the deadline you must send Copy A to the IRS and Copy B to the independent contractor a recipient. For the tax year 2020 the deadline for filing Form 1099-NEC is February 1 2021. Nothing on that TTax-designed page says anything about the menu items under FILE as applying only to personal 1040 Tax Returns.

The IRS does not provide a fill-in form option for Copy A. File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. If the filer wants to file the 1099-Misc Tax Form through electronic filing then the filer must choose the E-file provider.

Use Form 1099-NEC to report nonemployee compensation. Current Revision Form 1099-NEC PDF Information about Form 1099-NEC Nonemployee Compensation including recent updates related forms and instructions on how to file. Choose easy and find the right product for you that meets your individual needs.

A paper or electronic copy of the form 1099-NEC must be filed directly with FTB even if you file it with the IRS. Filer gets copies of 1099- Misc Form from the IRS website if filer wants to use paper filing. TaxBandits allows you to e-file Form 1099-NEC easily and securely.

These information will be displayed on both forms 1099-nec and 1096 Step 13. File your 1099 with the IRS for free. For tax year 2020 or a prior year entities or people who have paid you money during the year but who are not your employer will mail you a 1099-MISC form for.

Add 1099-NEC Forms 131 Click the top menu Current Company-Form 1099 to view 1099 form list screen 132 Click Add 1099-NEC to Fill out 1099-nec information and Print Forms Step 14. TurboTax is the easy way to prepare your personal income taxes online. Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures.

The new 1099 NEC form replaces Form 1099-MISC Box 7 for reporting nonemployee compensation. If you have questions about reporting on Form 1099-NEC call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free. You can submit all 1099 forms including Form 1099-NEC to the IRS by mail or online using the Filing Information Returns Electronically FIRE system.

The penalty rate will continue to increase 110return if you file after 30 days but before August 1 and to 280return if you file after August 1. A filer must file the 1099 Form before. E-file online with direct deposit to receive your tax refund the fastest.

Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each. How To E File 1099 NEC Form. To file electronically you must have software that generates a file according to the specifications in Pub.

With Form 1099-NEC IRS accelerated the due date for filing Form 1099 that includes non-employee compensation NEC from February 28 to January 31 and eliminated the automatic 30-day extension for forms that include NEC. Menu items under FILE -- I had just finished entering 1099-NEC data see Image 3 below and wanted to eFile. The best way to avoid penalties is to E-File Form 1099 NEC easily with ExpressEfile and get the filing status instantly.

TurboTax online makes filing taxes easy. 1099 E-file provider provides free 1099-Misc 2020 for reporting payments with the IRS. Then keep a Copy C for your business records and Copy 1 should be sent to the state department if needed.

You can get Adob. The Benefits of Filing Online E-filing saves time and effort and it helps ensure accuracy. You can get the form here.

You must register with the FIRE system by filing an online application.

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

Tax Payment Tax Payment Income Tax Return Income Tax

Tax Payment Tax Payment Income Tax Return Income Tax

1098 E User Interface Student Loan Interest Statement Data Is Entered Onto Windows That Resemble The Actual Forms Impo Irs Student Loan Interest Irs Forms

1098 E User Interface Student Loan Interest Statement Data Is Entered Onto Windows That Resemble The Actual Forms Impo Irs Student Loan Interest Irs Forms

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

How To Electronically File Irs Form 1099 Misc Youtube

How To Electronically File Irs Form 1099 Misc Youtube

1099 B User Interface Proceeds From Broker And Barter Exchange Transactions Data Is Entered Onto Windows That Resemble The Actual Forms Irs Irs Forms Efile

1099 B User Interface Proceeds From Broker And Barter Exchange Transactions Data Is Entered Onto Windows That Resemble The Actual Forms Irs Irs Forms Efile

How To File Form 1099 Nec Electronically Youtube

How To File Form 1099 Nec Electronically Youtube

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

Account Ability Form 1098 User Interface Mortgage Interest Statement Data Is Entered Onto Windows That Resemble The Actual Accounting Spreadsheet Irs Forms

Account Ability Form 1098 User Interface Mortgage Interest Statement Data Is Entered Onto Windows That Resemble The Actual Accounting Spreadsheet Irs Forms

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Irs 1099 Int Form Irs Authorized Services In Kansas Us Irs Efile Irs Forms

Irs 1099 Int Form Irs Authorized Services In Kansas Us Irs Efile Irs Forms

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemb Fillable Forms Irs Forms Letter Template Word

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemb Fillable Forms Irs Forms Letter Template Word

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

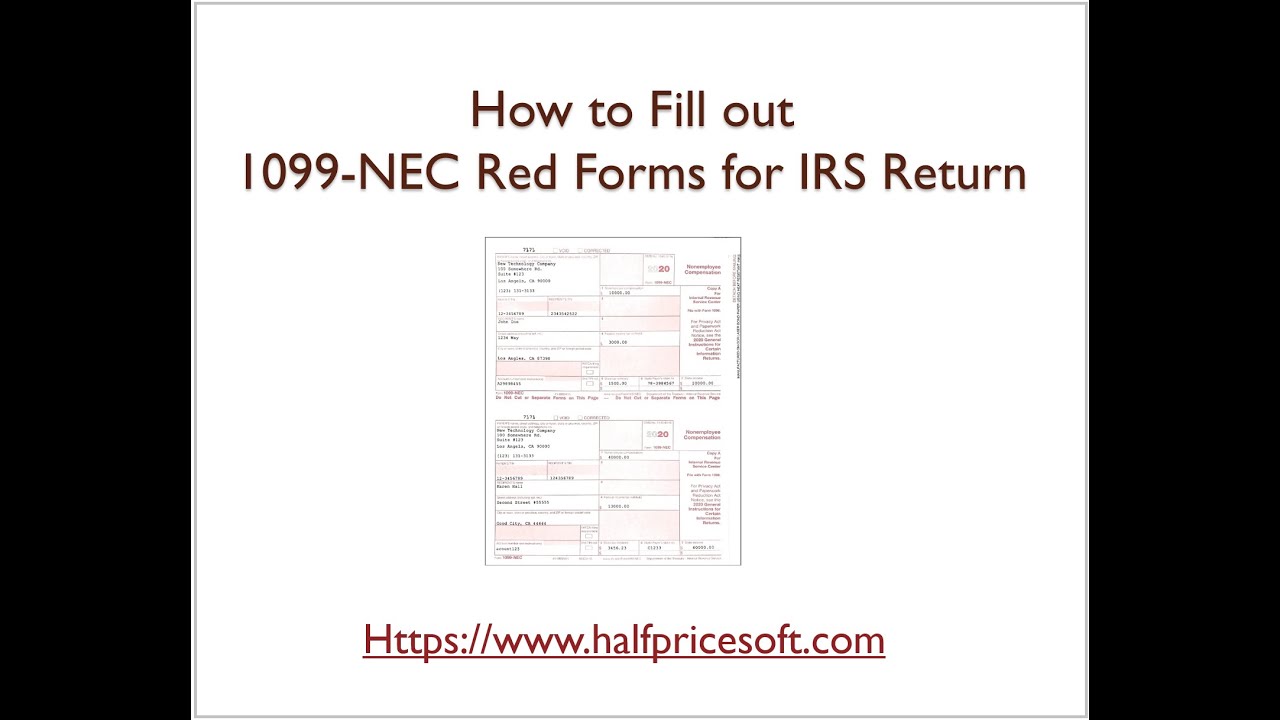

How To Fill Out 1099 Nec Red Forms For Irs Return Youtube

How To Fill Out 1099 Nec Red Forms For Irs Return Youtube